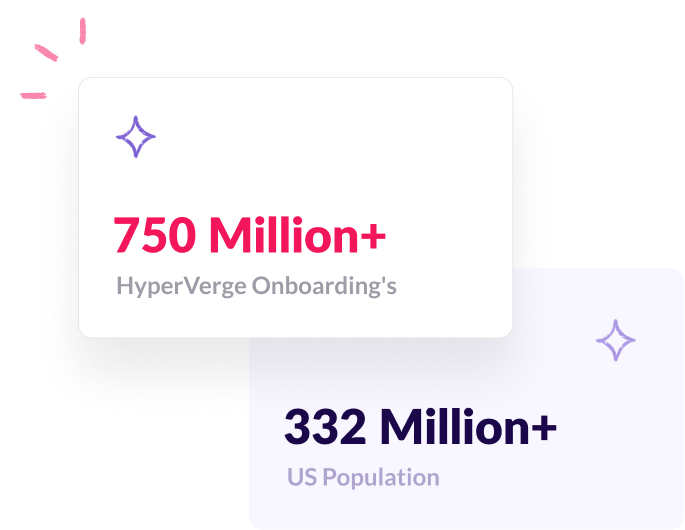

Let’s Visualize Our Scale

Trained on diverse facial variations and ID formats, our robust AI solutions have onboarded over 750 million users.

$300M+

Saved in fraud losses

~10Sec

Document Collection TAT

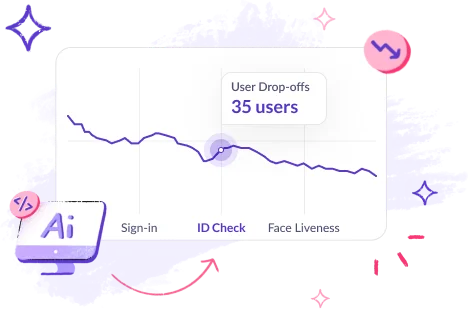

50%

Reduced Drop-off Rates

Financial Institutions Struggle

with Seamless User Onboarding

Video KYC

Onboarding Time

Friction in Customer

Onboarding

Constantly Changing

RBI Regulations

Increasing Fraud

Occurrences

We offer a Comprehensive

User Onboarding Solution

KYB - Know Your Business

Ultimate Business Owner (UBO) KYC checks.

Ultimate Business Owner (UBO) KYC checks.

Screening for country-specific and global sanctions.

Screening for country-specific and global sanctions.

OCR extraction for GST, Udyam certificate, & more.

OCR extraction for GST, Udyam certificate, & more.

Video KYC

RBI compliant video KYC platform.

RBI compliant video KYC platform.

Increased agent productivity & operational efficiency.

Increased agent productivity & operational efficiency.

Instant decision with AI-driven OCR, Liveness, FaceMatch.

Instant decision with AI-driven OCR, Liveness, FaceMatch.

Orchestrator

Rapid launch of new customer journeys without coding / app releases.

Rapid launch of new customer journeys without coding / app releases.

Customer applications management, & actionable business insights.

Customer applications management, & actionable business insights.

Seamlessly integrate multiple vendors via our unified API Marketplace.

Seamlessly integrate multiple vendors via our unified API Marketplace.

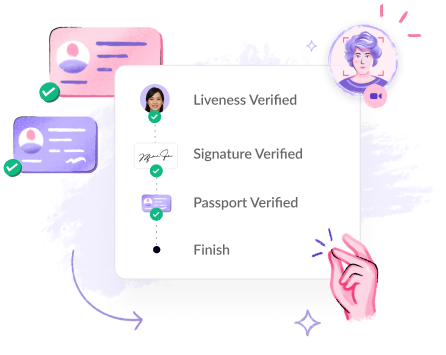

Face Match & Liveness

Simple selfie-based liveness detection.

Simple selfie-based liveness detection.

Accurately match selfie & ID card images.

Accurately match selfie & ID card images.

Ensure user authenticity & prevent frauds.

Ensure user authenticity & prevent frauds.

Non-Face-to-Face KYC Modes

KYC Record Search, Download, Upload & Quality checks.

KYC Record Search, Download, Upload & Quality checks.

Seamless KYC completion with Digilocker solution.

Seamless KYC completion with Digilocker solution.

Instant Aadhaar verification through OTP-based KYC.

Instant Aadhaar verification through OTP-based KYC.

OCR - Optical Character Recognition

Accurate data extraction from major government ID cards.

Accurate data extraction from major government ID cards.

Includes ID card detection, OCR, ID liveness check, etc.

Includes ID card detection, OCR, ID liveness check, etc.

Quality checks & compliance checks on the ID cards.

Quality checks & compliance checks on the ID cards.

Why is KYC required by NBFCs and banks?

KYC is required by NBFCs and banks to prevent fraud, money laundering, and comply with regulatory guidelines.

What are the consequences for non-compliance with KYC regulations?

Non-compliance with KYC regulations can lead to penalties, reputational damage, suspension of operations, or license revocation for NBFCs and banks.

What are some common challenges faced by NBFCs and banks in the KYC process?

Common challenges in the KYC process for NBFCs and banks include managing a large volume of applications, verifying complex business structures, and staying up to date with changing regulations.