Forgery isn’t new, but it has never been this accessible, this realistic, or this fast.

With the rise of AI-powered image generation tools like GPT-4o, DALL·E, Stable Diffusion, and Gemini, creating believable fake IDs and documents is now as simple as typing a few prompts. What once required skilled design work can now be done by anyone with a smartphone and an internet connection.

This shift poses a serious threat to digital onboarding systems worldwide, especially in sectors such as banking, lending, insurance, and fintech, where identity and document verification are foundational.

We have been closely tracking this trend. We found that many AI-generated ID cards, utility bills, salary slips, and even passports shared online are sufficiently accurate to deceive both human reviewers and traditional rule-based KYC systems. These documents are not only visually accurate but also contain details that pass OCR and template-matching validations.

Understanding the AIGC Threat Landscape

AIGC stands for AI-Generated Content. It refers to text, images, audio, or video created entirely by artificial intelligence models. In the context of document fraud, AIGC includes synthetic IDs, bills, certificates, and financial proofs generated by tools like GPT-4o, DALL·E, and Stable Diffusion. These tools lower the barrier to forgery by producing highly realistic content at scale with minimal effort.

Generative AI has democratized document forgery. With platforms like GPT-4o, Gemini, and DALL·E, what used to take hours in Photoshop can now be achieved with a single prompt.

A prompt like “Generate a bank statement with three salary credits from Company X” or “Create a Canadian passport with visa stamps for Europe” can produce:

- Realistic logos, seals, and emblems

- Convincing signatures, QR codes, barcodes

- Visually perfect formatting that mirrors real documents

Even more concerning: These files often pass visual scrutiny and sometimes even basic OCR, unless advanced AI detection systems are in place.

The New Age of Document Forgery

Today’s document forgeries fall into multiple categories, all of which are now significantly easier with AIGC. These aren’t limited to IDs alone but span employment, financial, and identity documentation.

i) Fully AI-Generated Documents

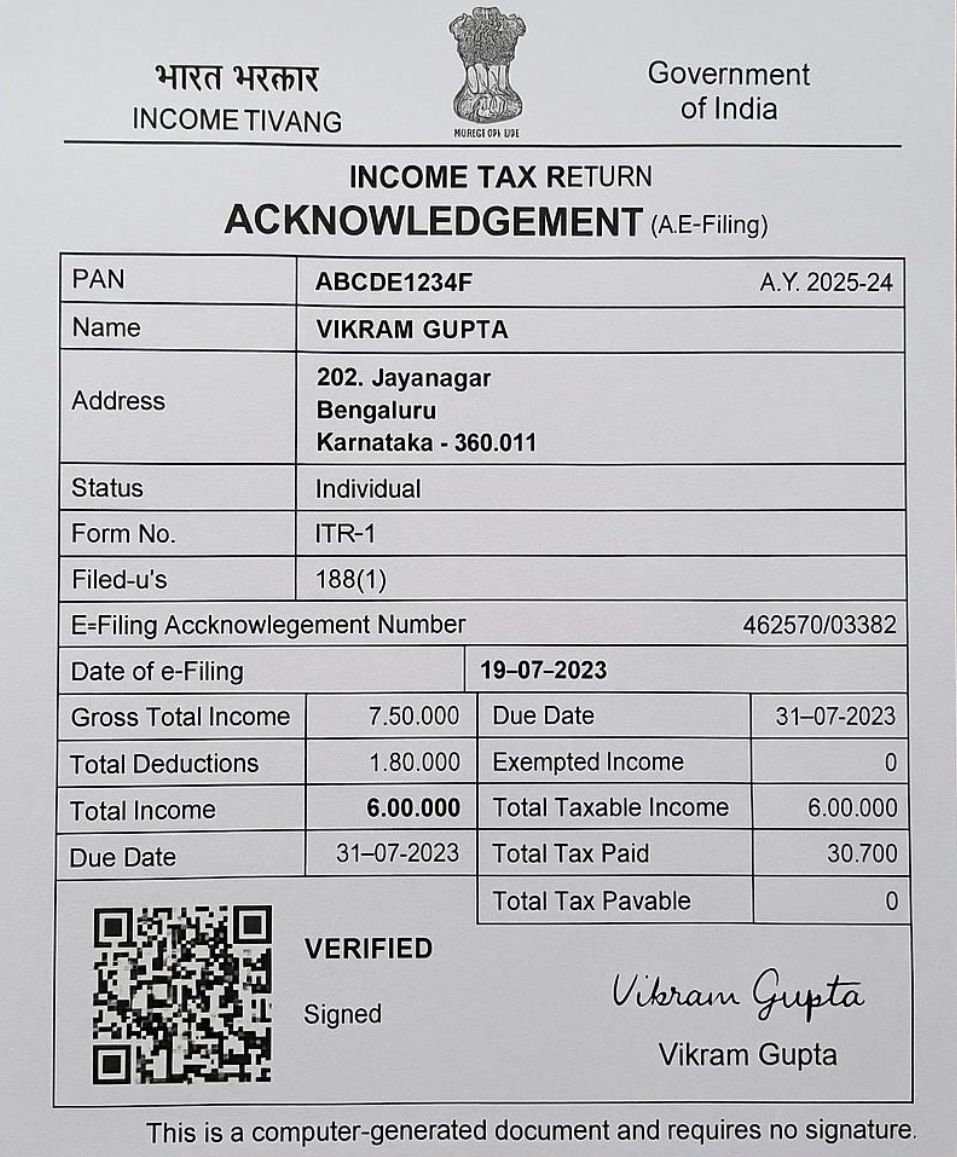

Completely fabricated documents created from scratch by generative AI, such as driver’s licenses, tax returns, or payslips also called synthetic identity theft. These have no real-world reference but mimic genuine layouts perfectly.

ii) Digitally Manipulated Originals

Authentic documents that are slightly altered, such as name, ID number, date of birth, or income figures, using AI-powered editing tools. Example: A genuine salary slip where only the salary amount is increased via AI editing used to inflate income during a loan application.

a) Manually Altered IDs and Docs

Often used in semi-digital or low-tech regions. Examples include:

- Replacing photos with printed mugshots

- Handwritten corrections

- Physical cut-and-paste

With AI, these crude edits can be scanned and polished to appear professional.

Right: Digital manipulation made easier with AI-generated forgeries using tools like GPT.

b) Deepfake Selfies + Document Combos

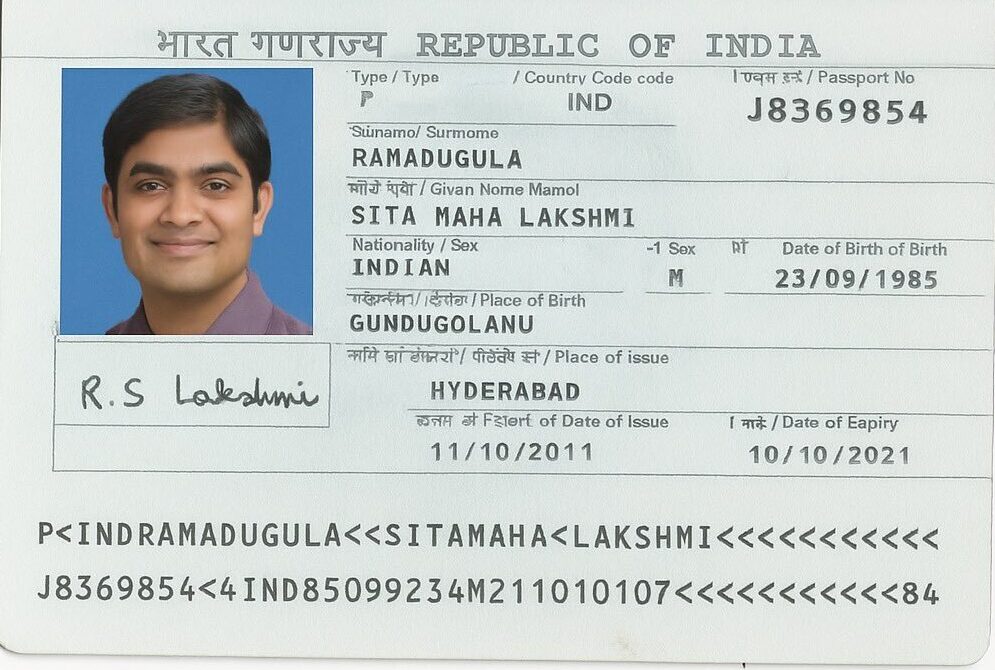

Fraudsters generate deepfake videos or AI-crafted selfies to match fake IDs, creating a dual-layer attack on KYC systems. Example: A deepfake video where a user blinks and moves, seemingly holding a passport, while both the face and document are synthetically generated.

Global Edge Cases Most Systems Miss

Some types of document fraud are particularly tricky. Here’s where legacy systems often fail:

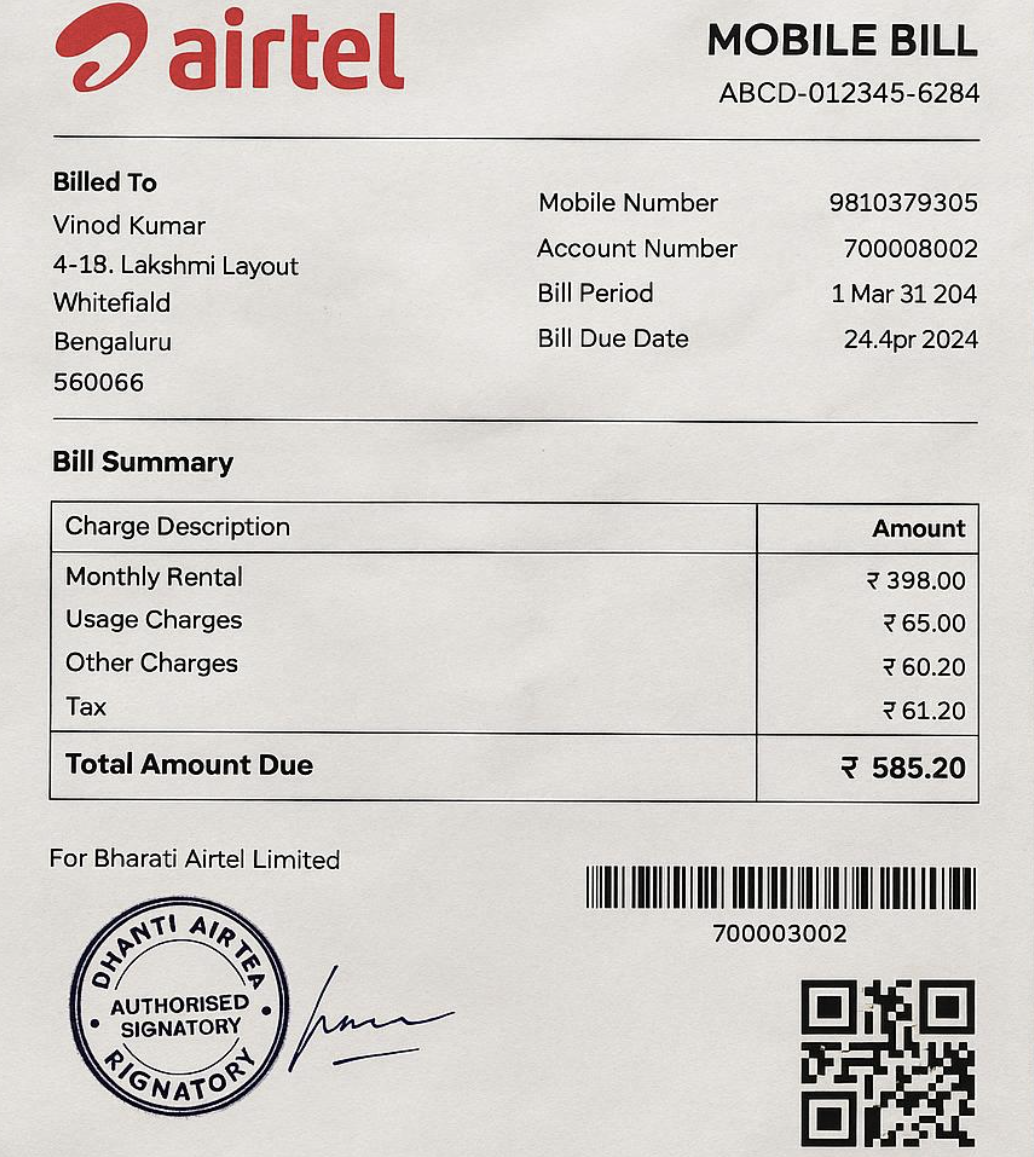

i) Fake Utility Bills + ID Combos/

Used as address proof in many onboarding flows, utility bills are easy to replicate using AI. When paired with fake government IDs, the identity package looks complete. Example: A synthetic phone bill for “XYZ company” paired with a fake driver’s license that reflects the same address, used to pass residential verification in fintech onboarding.

ii) Structurally Invalid Government IDs

While most AI-generated national IDs look realistic, they often fail deeper validations, like checksum logic or regional encoding.

iii) Hybrid Passports and Visa Stamps

Fraudsters use a real passport front page (with a valid MRZ) and pair it with AI-generated visa or entry-exit pages to falsify travel history.

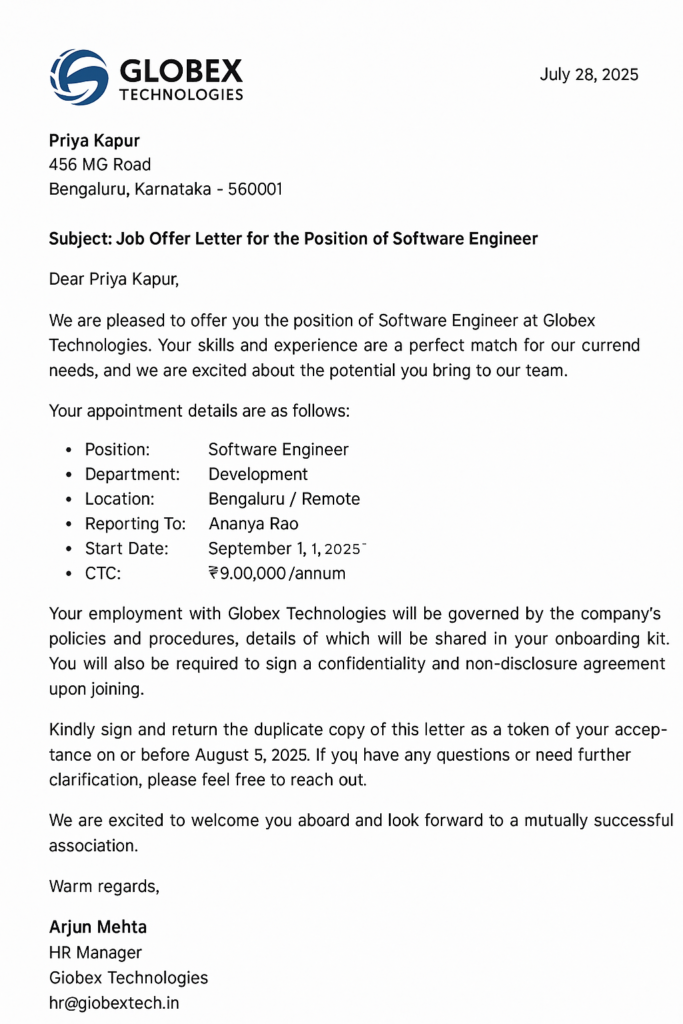

iv) Fake Employment Proofs and Education Certificates

Education and employment documents are easily forged today. With AI-generated templates, forged experience letters and certificates can be made to look credible. Example: A fake job letter from “Globex Technologies” with a forged logo and fake HR signature, supported by a synthetically created college degree.

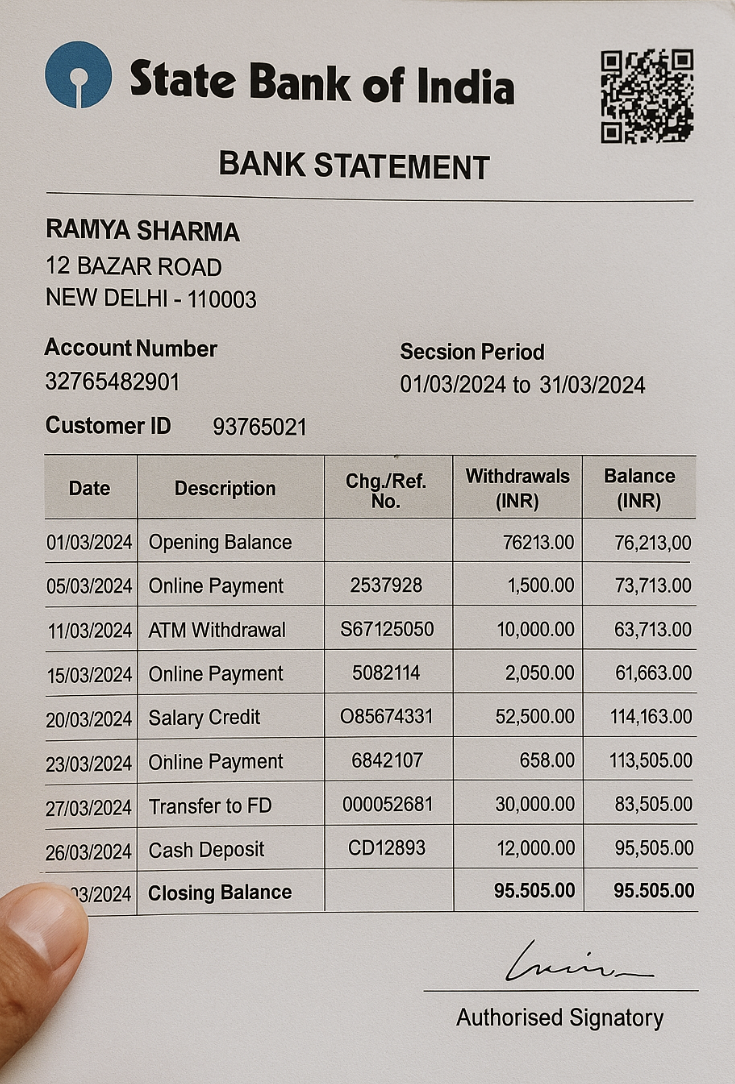

v) Forged Financial Statements

Fraudsters are now generating:

- Bank statements showing stable salary credits

- Salary slips with digital signatures

- GST filings with fake QR codes

These are used in underwriting, credit checks, and tax benefits.

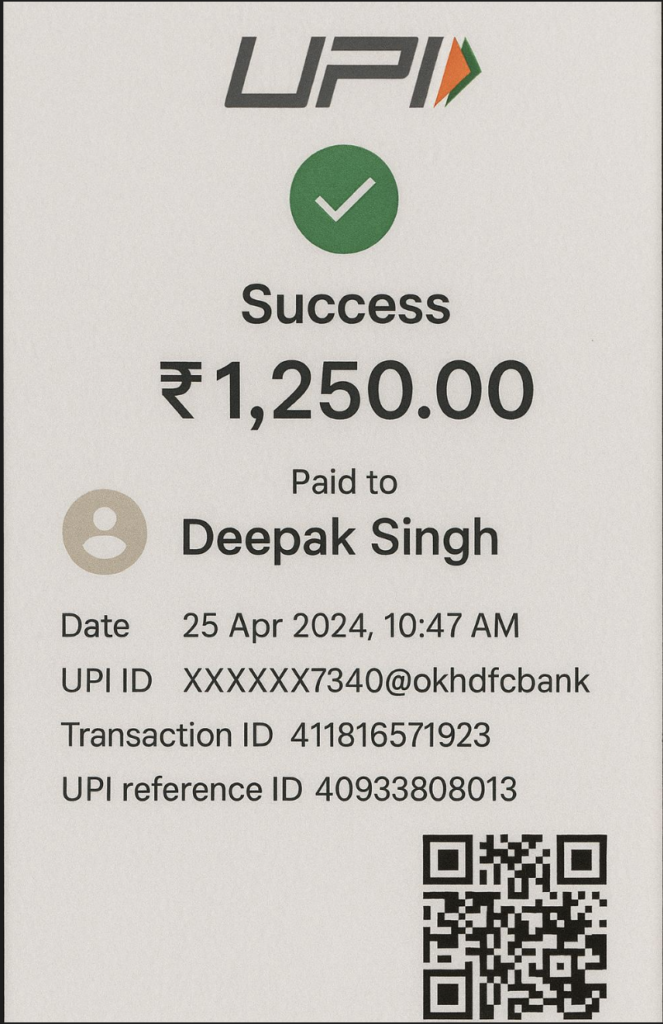

vi) Fake UPI Receipts Used in Payment Fraud

With peer-to-peer fintech apps booming, another rising fraud vector is the use of AI-generated UPI receipts or transaction confirmations. Example: In the image below, a fraudster creates a fake screenshot of a successful ₹1,250 payment using design tools or image generators. This is used to trick merchants, small lenders, or gig platforms into believing payment has been made, leading to shipment, service, or release of goods.

These are often not caught because many platforms don’t do backend UPI confirmation in real time, especially during manual review flows

Document Fraud at Enterprise Scale: A Global Fintech Challenge

Document forgery has exploded beyond IDs. AI is now being used to mass-produce convincing versions of financial paperwork such as tax returns, invoices, bank statements, and salary slips.

Fintech firms today aren’t just dealing with one-off fake IDs; they’re facing enterprise-grade fraud operations.

AI tools are being used to mass-produce convincing financial documents at scale:

- Fake 1099 forms are used in the U.S. for income verification or to claim unemployment benefits.

- Fabricated GSTR-3B filings in India to show business health and claim loans.

- AI-generated vendor invoices are used to commit merchant fraud or to apply for SME loans.

These forgeries pass basic visual checks and often go undetected by static rule-based systems. At enterprise scale, the volume and sophistication of such forgeries are growing exponentially, leading to increased risk exposure.

How HyperVerge Detects the Undetectable

AIGC Detection Layer

HyperVerge has developed new AIGC capabilities with trained proprietary models to spot AI-generated ID cards and documents, detecting:

- Generative patterns left behind by tools like GPT-4o, Gemini, DALL·E

- Lighting, shadow, and depth mismatches

- Inconsistencies in pixel-level texture

Our models continue to learn from new document samples daily.

Global Forgery Checks (GFC):

Apart from AIGC detection, we also offer global forgery checks, such as: In addition to AIGC detection, we provide more forgery checks in our global forgery checks portfolio:

- Digital Text Forgery: Catches micro-edits like DOB, ID numbers, and account details.

- Physical Text Forgery: Detects scanning artifacts, misaligned overlays, and paper inconsistencies.

- Photo Forgery: Identifies fake photos, photo overlays, or AI-replaced ID photos.

Biometric and Liveness Defense

Our AI detects spoofed selfies, deepfake videos, and synthetic faces using facial micro-movements and real-time challenges.

What We Found: Testing AIGC Forgeries

We conducted extensive red-team testing using:

- Publicly shared AI-generated fake documents

- Documents we generated internally using GPT-4o and similar tools

Findings:

- Our model caught 90%+ of AI-generated Aadhaar cards, PAN cards, and utility bills

- Semantic errors (e.g., fake ID numbers) flagged with structural validation

- Visually perfect forged payslips and degree certificates detected through image artifact analysis

Our system outperformed traditional template matching and OCR-only approaches.

Why Businesses Must Act Now

Ignoring This Wave = High Risk

- Regulatory Fines: Non-compliance with KYC mandates can invite penalties

- Reputation Damage: Onboarding synthetic identities can lead to public scandals

- Operational Risks: Synthetic IDs often act as mule accounts /for laundering

Whether you process 100 or 100,000 verifications a month, ignoring AI-driven forgery opens your doors to systemic abuse.

What Businesses Can Do Next

Here’s how to future-proof your onboarding:

- Audit your document verification stack

- Upgrade to include AIGC-aware models

- Train compliance teams with fresh fraud examples

Layer your verification: image + logic + biometric validation

Conclusion

The world is seeing a flood of hyper-realistic fake documents that can easily pass legacy verification tools. But the good news is: the same technology that created this problem also holds the key to solving it.

HyperVerge’s AI-first approach ensures your systems stay ahead, constantly learning from the newest forgery methods and evolving just as fast.

Because in the age of AI, only AI can detect AI.

Book a demo and let your team test your current onboarding stack against next-gen forgery threats. Don’t wait until fraud hits your pipeline. Detect it before it happens.

FAQ’s:

1. What is AI-generated document forgery, and how is it different from traditional forgery?

AI-generated forgery uses generative models like GPT-4 or DALL·E to create hyper-realistic fake documents from simple prompts. Traditional forgery required photo editing tools, time, and expertise; this no longer applies.

2. Can AI-generated IDs bypass current KYC verification systems?

Yes. Most traditional systems check format and appearance. AIGC forgeries mimic these perfectly unless detection systems are AI-trained.

3. What are the most commonly faked documents using AI today?

Government IDs (like Aadhaar, PAN, SSNs), utility bills, salary slips, tax returns, driver’s licenses, and passports are the most targeted.

4. How can businesses protect themselves from AI-powered forgeries?

By deploying AI models trained to detect AIGC patterns, using biometric liveness checks, and verifying structural logic (not just visual correctness).

5. Can I test if my existing system is catching AI-generated fraud?

Yes. HyperVerge offers demo simulations with real-world AI-generated document samples to test your system’s accuracy.