Financial data sits at the center of every credit or lending decision.

But most teams still spend hours chasing bank statements, verifying PDFs, and piecing together a user’s financial profile across siloed sources. And while they try to make sense of it, opportunities slip away. That’s exactly what an Account Aggregator (AA) solves.

With consent-based, structured data sharing, AA is changing how financial information gets shared, without risking confidentiality.

If you’re still chasing documents manually or stuck somewhere in between, this manual tracking vs Account Aggregators guide is worth your time, where we break down both concepts in detail.

Understanding manual financial data tracking

Manual financial data tracking for businesses involves the deliberate, hands-on process of collecting, recording, and organizing financial information without the support of real-time automation.

Finance teams manually source data from bank portals, invoices, or internal tools to log income, expenses, liabilities, and cash flow metrics.

This information is then structured into formats suited for internal reviews, audits, or reporting workflows. Despite digital progress, many businesses, especially in traditional sectors or smaller setups, still rely on manual data entry methods for their day-to-day financial tracking.

Here are some of the common methods of manual tracking used by businesses and individuals:

- Notebooks and ledgers: Still prevalent in informal or semi-digital businesses, especially in Tier 2/3 regions, where transactions are handwritten and then reconciled periodically

- Spreadsheets: Widely used for internal reporting, spreadsheets offer flexibility but require manual data extraction from emails, PDF statements, or bank exports

- Budgeting tools: Though packaged as smart apps, many still depend on finance teams for manual data collection, entry, and analysis.

Now, manual financial data tracking comes with its own set of strengths and limitations.

| Pros | Cons |

| – Complete control over how data is collected, organized, and stored – No reliance on third-party platforms, which means financial data stays within internal systems – Less exposure to external data breaches, especially when records are offline or stored locally | – Creating reports or pulling insights manually is extremely time-consuming – High risk of human error during data entry, reconciliation, and reporting – Hard to scale as transaction volume and account complexity increase – No real-time view into finances leads to delayed financial insights and decision-making – Fragmented records make audits, compliance checks, and internal reviews more difficult |

Read More: Key Terms for Bank Account Verification in India

Exploring Account Aggregators

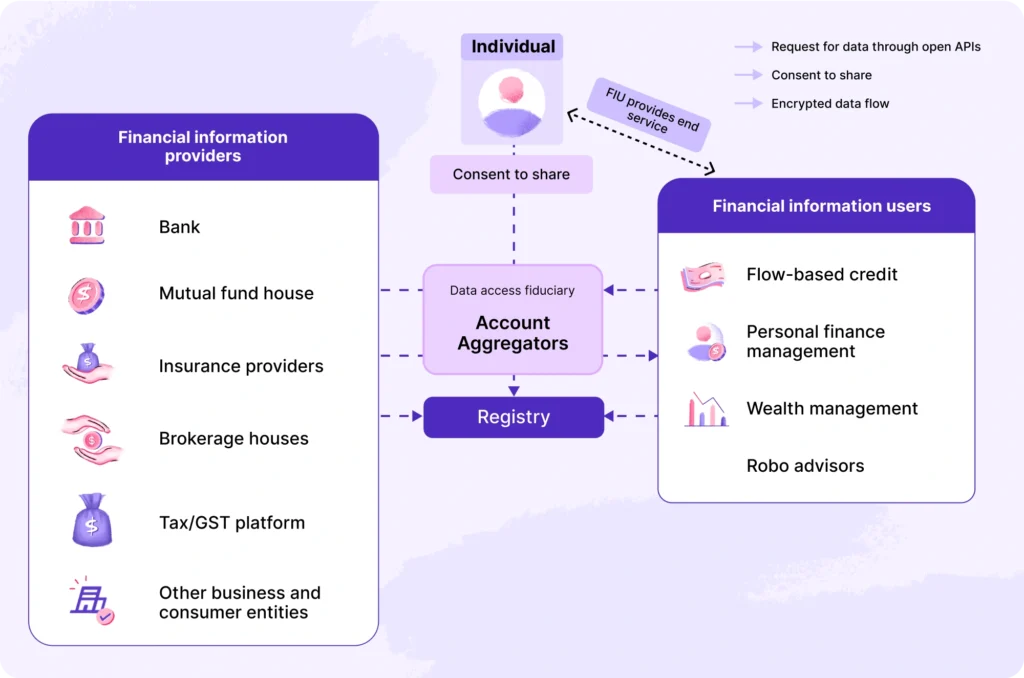

Account Aggregators (AA) are financial data sharing platforms that extract consented financial information from a Financial Information Provider (FIP) and share it with a Financial Information User (FIU).

In the AA framework, users have full control over how their financial data is shared and with whom. They can revoke consent at any time, which immediately cuts off access.

Do note that AA acts purely as a secure transmission system. It does not read, store, or analyze data at any point in the process.

How does an Account Aggregator ecosystem work?

- A user logs into an Account Aggregator platform

- They link their bank accounts, investment accounts, and insurance policies to the platform, i.e., financial institutions that would provide information

- Once the accounts are linked, the user gets a dashboard that shows all connected accounts and financial data in one place

- When a lender, insurer, or wealth management firm, i.e., FIU, needs specific information, they send a data access request through the AA platform

- The user reviews all the details of the request and shares consent

- After the user approves, the aggregator collects the requested data directly from the selected Financial Information Providers (FIPs) and transmits the encrypted financial data to the requesting institution

In India, Account Aggregators operate under the RBI-regulated NBFC-AA (Non-Banking Financial Company – Account Aggregator) license. They have set the base for open banking in India, allowing users to share their data with consent.

Like manual data tracking, even Account Aggregators have strengths and weaknesses.

| Pros | Cons |

| Real-time access to financial data from multiple accounts in one place Encrypted, consent-based data sharing reduces the risk of misuse Offers a consolidated financial overview that’s easy to monitor and track | Some users may hesitate to link accounts due to a limited understanding of how the system works Extracting data from the AA platform involves a cost, even if it’s minimal FIUs can’t access data from institutions that haven’t joined the AA framework, which limits coverage |

Fetch customer bank account statements in real time

with Hyperverge’s Bank Statement API Schedule a DemoManual tracking vs. Account Aggregators: A comparative analysis

Below, we break down manual tracking vs. Account Aggregators in great detail to help you understand which fits your financial tracking needs better.

- Accuracy

Businesses have been using spreadsheets to log and analyze financial data for years. But is it accurate?

- Manual data tracking: Here, a business manually enters financial data into spreadsheets. The task of data entry is tiring and error-prone. In fact, studies suggest that nearly 88% of spreadsheets have data entry errors in them. Now, imagine relying on those numbers to prepare reports, make credit decisions, or file compliance documents.

- Account Aggregator: An AA directly fetches data from the financial institutions. And since the data is pulled through APIs and standardized formats, the chances of entry errors or mismatched figures are nearly zero. Besides, information is captured in real-time, meaning the information shared is consistent with what’s stored at the source.

- Efficiency

Now that we understand accuracy, let’s see which method saves more time and reduces routine work without cutting corners.

- Manual data tracking: When gathering data for financial services, businesses need to request documents, verify their accuracy, extract valuable insights, and analyze them for decision-making. Doing all this manually is time-consuming and resource-heavy. And by the time a decision is made, the customer’s financial position may already have changed.

- Account Aggregator: AA captures the required data from FIPs in real time. Since the information comes directly from the source, there’s no need for manual verification or repeated KYC checks. The FIU receives accurate, structured data almost instantly, which speeds up the entire process and cuts down on effort.

- Cost

Manual tracking seems low-cost until you count the hidden expenses behind it. Let’s see how both these method compares on the cost front:

- Manual data tracking: Manual methods may seem cheaper upfront since they rely on tools already in place, like spreadsheets, for instance. But manual accounting is expensive, and if businesses consider the hidden costs, it’s almost impractical to still rely on it.

- Hours spent on data entry, document verification, income verification, and updates

- Additional staff needed to manage records and reporting

- Time lost due to rework caused by entry errors or outdated data

- Missed opportunities due to slow processing or delayed approvals

- Higher risk of non-compliance from incomplete or inconsistent records

- Account Aggregator: AA platforms usually involve a usage-based fee for the FIUs. The cost can be anywhere from ₹1 to ₹60 for each consent request. But in return, businesses save significantly on time, staffing, and processing delays. The cost is predictable, and the value increases as the volume of data requests grows. For companies that rely on frequent financial data checks, Account Aggregators are clearly cost-effective.

- Security

Security matters more than speed or convenience when the financial data can reveal personal details like income levels, credit history, outstanding loans, or spending behavior. Let’s see which method keeps sensitive information better protected.

- Manual data tracking: Manual tracking is generally safe since data isn’t shared through third-party tools. However, if multiple people are involved in handling the files, the confidentiality of the data may not be maintained.

- Account Aggregators: AAs use encrypted, consent-based data sharing. The data moves directly from the source to the requester without being stored. Only approved users can access it, and every action is logged. This setup limits human involvement and lowers the risk of data misuse. However, users are more skeptical and resistant to sharing their data, mainly because they don’t understand the robust infrastructure of the Account Aggregator ecosystem.

- User experience

Lastly, let’s compare how each method handles day-to-day usability for teams and end users.

- Manual data tracking: Manual systems can be tedious to work with. Data is siloed across bank accounts, insurance policies, loan statements, and spreadsheets. There’s no single source of truth, and even basic tasks can take much longer than they should.

- Account Aggregator: AA platforms simplify consent-based data sharing for users. They just need to link their accounts once to get a dashboard with a complete financial overview. FIUs can request specific data through a single workflow without repeated follow-ups. This cuts delays and streamlines onboarding.

Read More: How To Do Bank Statement Analysis: A Step-By-Step Guide

Suitability: Which method fits your financial needs?

Account Aggregators are efficient and accurate. But does every individual or business need to use them, especially when there are costs involved? Let’s break it down.

For individuals

- Manual data tracking: Best for those who prefer complete control over their data, i.e., individuals with limited accounts and basic tracking needs

- Account Aggregator system: Ideal for individuals with multiple accounts who want detailed knowledge of their accounts and a unified financial view

For businesses

- Manual data tracking: Works for very small businesses that have limited transactions and can manage finances manually, i.e., local shops

- Account Aggregator system: Fits businesses that need frequent access to accurate financial data for credit, compliance, or customer onboarding, i.e., fintech lenders, NBFCs, insurance providers, or wealth advisory platforms

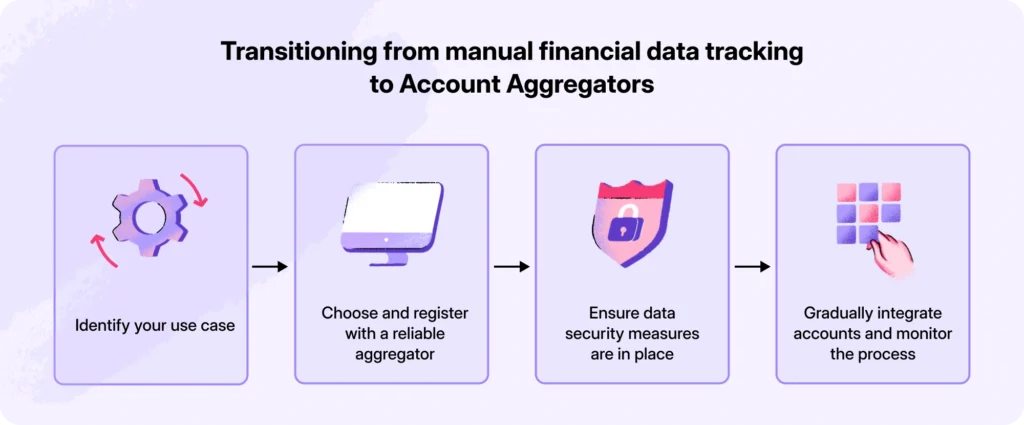

Transitioning from manual financial data tracking to Account Aggregators

Planning to switch from manual methods to an Account Aggregator setup? Let’s help you transition smoothly with a quick step-by-step guide.

- Identify your use case: Clarify whether you’re consuming data (FIU), supplying data (FIP), or both. Also, identify the type of documents and data you need. i.e., bank statements, loan repayment history, insurance details, or investment account summaries

- Choose and register with a reliable aggregator: Select an RBI-approved AA with proven performance and strong technical support. Review their API documentation, SLAs, and integration timelines before committing.

- Ensure data security measures are in place: Before going live, align your internal policies with RBI guidelines and make sure every access point is logged and monitored

- Gradually integrate accounts and monitor the process: Start with a limited set of accounts or data types. Validate the data flow and track failures and edge cases before scaling up to full production.

Here are the two tips that will help you with the transition:

- Before you transition to AA, request a sandbox or demo environment from the aggregator. Use it to see how the system fits into your workflow and whether the data flow works as expected

- As you move from manual to AA-based data flow, keep your existing processes in place. At least until you’re fully transitioned and confident that everything is working end-to-end

Verify a customer’s bank account

with up to a 95% success rate through Hyperverge’s Bank Account Verification API. Schedule a DemoFinal thoughts

Manual tracking might be enough when you’re collecting minimal data or working with simple use cases. But if your business depends on bank statements, income proofs, or other data to make financial decisions, manual methods fall short fast.

In other words, for anything beyond the basics, a manual tracking system won’t cut it. You need an Account Aggregator to access verified financial data quickly, securely, and at scale.

Want to connect with an Account Aggregator? HyperVerge’s AA-ready API makes it easy to fetch real-time financial data, securely and with full user consent.

What’s more? You get access to digitally signed, tamper-proof statements while giving users full control over what they share and with whom. Our solution also supports compliant consent capture and account linking across deposits, insurance, mutual funds, and more.

Want to know more? Sign up for a free demo with HyperVerge today!

FAQs

1. What is a manual tracking system?

A manual tracking system is a process where financial or business data is recorded, updated, and reviewed by hand. It often involves spreadsheets, paper logs, or offline tools without automation.

2. What is an example of manual data?

Manual data includes anything entered by a person, such as transaction amounts typed into a spreadsheet or expenses recorded in a notebook. It’s not pulled from a digital source automatically.

3. What are examples of data tracking?

Some examples of data tracking include:

- Tracking daily expenses

- Monitoring account balances

- Updating loan repayments

- Logging invoice status

3. What is the manual method of data collection?

Manual data collection involves gathering information by physically reviewing sources, like downloading bank statements, checking receipts, and entering the details into a file or system yourself.