As cyber threats evolve, securing digital identities has become a top priority for businesses and regulatory bodies. Electronic Identity Verification (eIDV) is emerging as the most effective solution, offering never-seen-before accuracy, speed, and compliance.

While Know Your Customer (KYC) regulations mandate identity verification, traditional manual methods are slow, error-prone, and vulnerable to fraud. False positives, data security concerns, and operational inefficiencies make verification a complex challenge for compliance teams. eIDV addresses these issues by leveraging AI-driven automation, document and biometric verification, and real-time data validation.

In this article, we explore the latest advancements in eIDV and how businesses can use this technology to enhance security, prevent fraud, and accelerate digital transformation.

What is electronic identity verification (eIDV)?

Electronic Identity Verification (eIDV) is the process of confirming an individual’s identity using digital tools and technologies. eIDV uses publicly available data as well as private databases to verify customer identities using automated heuristic checks.

There are several forms of eIDV, including:

- Document verification

- Biometric verification

- Database lookups

- Watchlists

- Proof of Address

eIDV is not just about checking boxes for compliance; whether you’re opening a bank account, booking a flight, or accessing healthcare services, eIDV ensures that you are who you claim to be.

The process typically involves:

- Data collection: Users provide personal information and upload identity documents.

- Verification: The system checks the data against trusted sources, such as government databases or credit bureaus.

- Authentication: Advanced methods like facial recognition or fingerprint scans are used to confirm the user’s identity.

eIDV is particularly valuable in combating identity fraud, which costs businesses billions annually. By automating the verification process, eIDV reduces human error and speeds up onboarding, making it a win-win for businesses and customers alike.

What types of businesses use electronic verification?

eIDV is versatile and applicable across industries. Here’s how different sectors leverage it:

- Financial services

Banks, fintech companies, and investment platforms use eIDV to verify customers during account opening, loan applications, and transactions. It helps them meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements while reducing fraud.

For example, when you open a bank account online, eIDV systems scan your ID, cross-check it with government databases, and use facial recognition to ensure you’re who you claim you are. This process not only prevents fraud but also ensures compliance with global regulations like GDPR and eIDAS.

The financial services industry may also use eIDV to filter different kinds of financial crimes, including terrorist financing.

- Healthcare

Healthcare providers use eIDV to verify patient’s digital identities, ensure accurate medical records, and prevent insurance fraud. It’s especially critical for telemedicine platforms offering remote consultations.

Imagine a patient booking an online consultation. eIDV ensures that the person logging in is the same individual registered in the system

- eCommerce

Online retailers use eIDV to verify buyers, prevent fraudulent transactions, and comply with age restrictions for certain products like alcohol or tobacco. For instance, when purchasing age-restricted items, eIDV systems can verify the buyer’s age by scanning their ID and matching it with their profile.

- Government services

Governments use eIDV for citizen document verification in services like tax filing, social security, and voting.

In countries like Estonia, eIDV is integrated into the national ID system, allowing citizens to access government services securely online. This greatly reduces paperwork and improves efficiency.

- Travel and hospitality

Airlines and hotels use eIDV to verify travelers’ identities during bookings and check-ins, ensuring smoother and safer experiences. For example, airlines use eIDV to match passengers with their boarding passes, reducing the risk of identity fraud and enhancing security at airports.

Also Read: Where Compliance Meets Safety: How to Implement an Age Verification System

Advantages of electronic ID verification (eIDV)

eIDV offers a range of benefits, let’s read a few below—

- Multi-layer security

HyperVerge’s eIDV systems use multiple different approaches to complete the verification process. It combines multiple verification methods, such as document checks, biometric scans, and database cross-referencing, to create a solid security framework.

This multi-layered security approach makes it much harder for fraudsters to use fraudulent documents to commit crimes, protects customer information, and reduces human errors.

- Enhanced customer experience

With eIDV, customers can have documents verified in seconds without the risk of manual errors. This makes it easier for customers to engage with businesses.

- Reduced risks

eIDV helps detect fake IDs, synthetic identities, and other fraudulent activities, protecting businesses from financial and reputational damage. For example, eIDV systems can flag inconsistencies in ID documents, such as mismatched fonts or altered photos, that might be missed by human reviewers.

- Automated compliance

With eIDV, businesses can automatically adhere to KYC, AML, and GDPR regulations, reducing the burden of manual audits. For instance, eIDV systems can automatically update customer records when regulations change, ensuring businesses stay compliant without suffering penalties.

- Long-term relationships

Businesses earn the trust of their customers by providing good service and keeping customer data safe. By helping with these efforts, electronic identity verification helps businesses build long-term relationships with ease.

Types of electronic identity verification (eIDV)

- Document verification

This involves scanning government-issued IDs (like passports or driver’s licenses) and using AI to detect tampering or forgery. eIDV systems can analyze the holograms, watermarks, and microprints on IDs to ensure they’re genuine.

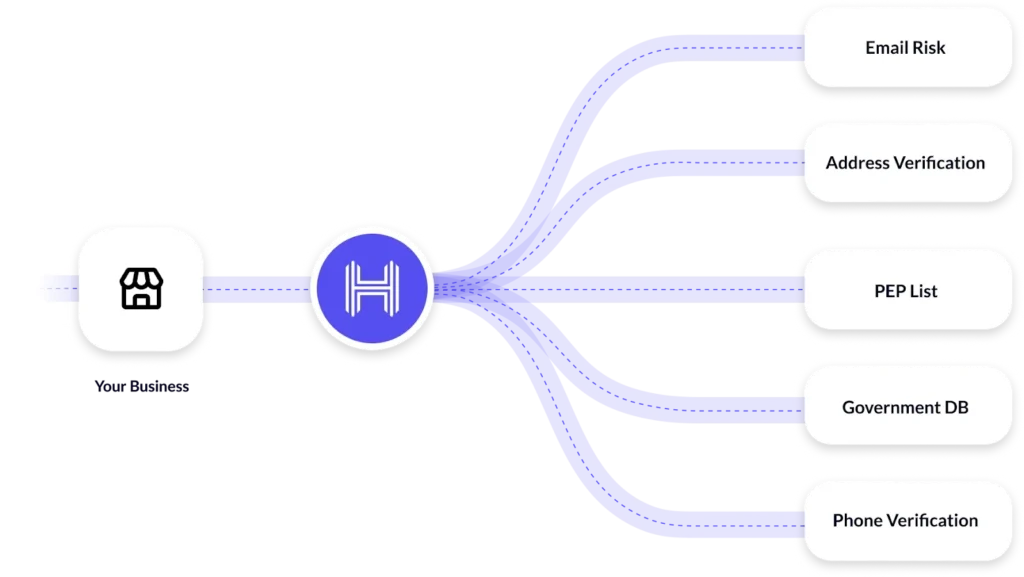

- Database checks

eIDV systems cross-check user-provided information against trusted databases, such as credit bureaus or government records. For instance, if a user provides their Social Security number, the system can verify it against official records to confirm its validity.

- Biometric verification

Facial recognition, fingerprint scans, and voice authentication are used to match users with their IDs, adding an extra layer of security. For example, a user might take a selfie, which the system compares with the photo on their ID to ensure a match.

How is eIDV used for KYC and AML?

1. PEP screening

HyperVerge’s eIDV helps identify Politically Exposed Persons (PEPs) who may pose higher risks due to their positions. For example, banks use eIDV to screen customers against PEP lists, ensuring they don’t inadvertently facilitate corruption or money laundering.

2. Watchlist screening

To make sure that criminals don’t get access to financial institutions, electronic verification systems screen them against watchlists. These watchlists come from a variety of sources, including the Office of Foreign Assets Control, the European Union, Interpol, and more.

3. Continuous monitoring and auditing

eIDV systems provide ongoing monitoring of customer identities, alerting businesses to any changes or risks in real time. This ensures compliance with evolving regulations.

For example, if a customer’s ID is flagged as stolen, the system can immediately notify the business.

Global eIDV trends to watch out for

- EU’s Electronic Identification and Signature (eIDAS) regulation

The eIDAS regulation allows European citizens to use their national electronic IDs to use public services in any country of the EU. By standardizing electronic identification, eIDAS enhances security, reduces fraud, and simplifies administrative processes for individuals and businesses operating within the EU.

- UK government’s trust framework

The UK government is spearheading an initiative to make digital identities as trustworthy as passports. To do this, they have established the Digital Identity and Attributes Trust Framework.

The framework aims to enhance user privacy, prevent identity fraud, and promote wider adoption of digital identity verification solutions in both public and private sectors.

- ID wallet solutions

Digital wallets that store verified identity documents are gaining traction, offering users a convenient way to share their credentials securely. For example, an ID wallet might store your driver’s license, passport, and health records, allowing you to share them with businesses as needed.

- The future of biometrics

Advancements in biometric technology, such as behavioral biometrics and liveness detection, are making eIDV more accurate and fraud-resistant.

- Digital driver’s license

Countries like the US and Australia are piloting digital driver’s licenses, which can be verified instantly using eIDV systems.

- Cross-border verification

eIDV simplifies identity checks for global businesses, helping them comply with international regulations like GDPR and eIDAS. For example, a business operating in multiple countries can use eIDV to verify customers’ identities while adhering to local laws.

- AI and machine learning

AI-powered eIDV systems are becoming smarter at detecting fraud, analyzing patterns, and improving verification accuracy over time. For instance, AI can identify subtle signs of forgery in ID documents that might be missed by human reviewers.

Fraud never sleeps—neither does HyperVerge!

HyperVerge’s lightning-fast ID verification ensures only real users get through. No delays, no loopholes. Schedule a DemoThe future of digital identity verification

- A comprehensive guide to card not present fraud

Card-not-present fraud is a form of fraud where the criminal uses stolen credit card information to make illegal transactions. It can be done online, via phone, or via mail. eIDV makes it harder to pull off by assisting with verification.

- AML fraud detection: how it works, benefits & challenges

A major advantage of eIDV is AML fraud detection. AML requirements mandate that companies perform thorough customer due diligence, and eIDV makes this process easier by automating identity verification, ensuring compliance with regulatory standards.

- Guide to fraud monitoring: what it is and why you need it

With the rise in digital transactions and online payment fraud, proper fraud monitoring is a must. To reduce the severity of this problem, companies can use eIDV to confirm the identities of anyone purchasing from them.

- Real-time identity verification

Manual verification is a slow process, and it introduces friction into transactions that need to be fast. Industries like financial services, eCommerce, and travel are adopting real-time eIDV to prevent fraud and enhance customer experiences.

- Privacy and data protection in eIDV

With regulations like GDPR, businesses must balance convenience with security, ensuring user data is handled responsibly. For instance, eIDV systems can encrypt user data, ensuring it’s only accessible to authorized parties.

- Identity fraud prevention

AI-enabled eIDV solutions can be used to prevent identity fraud. They can identify forged documents and synthetic identities, enabling fraudsters to be caught much faster.

- Remote customer onboarding

In today’s post-pandemic era, the need for remote solutions has skyrocketed.

Industries like fintech and healthcare among other sectors have started making heavy use of remote onboarding solutions. eIDV in such cases can make the verification process and onboarding much quicker and easier.

FAQs

1. What is electronic identity verification (eIDV)?

Electronic identity verification (eIDV) is a process that uses digital methods to confirm an individual’s identity. It involves cross-referencing personal information—such as name, date of birth, and address—against various public and private databases to ensure authenticity.

2. How does eIDV work?

eIDV operates by collecting personal data from an individual and comparing it to information stored in trusted databases. This may include verifying details from government records, credit bureaus, or utility companies. Advanced eIDV systems like HyperVerge also utilize biometric checks, like facial recognition, to enhance accuracy and security.

3. What is the difference between IDV and eIDV?

Identity Verification (IDV) is the broader process of confirming a person’s identity, which can be done manually or electronically. Electronic Identity Verification (eIDV) specifically refers to the digital approach, leveraging online databases and biometric technologies to expedite and secure the verification process.