If you are looking for top-notch loan origination solutions or considering a switch from your current provider, then you are at the right place.

Lentra is a reliable loan origination software known for its functionalities and performance.

However, businesses constantly look for newer or alternative software digital lending solutions that offer advanced capabilities or better suit their diverse needs.

To help you find the most suitable software that competes with Lentra, continue reading this guide.

This guide covers top Lentra alternatives, highlighting features, targeted industries, suitability for diverse business types, and availability of demos or free trials.

Why consider Lentra alternatives?

Lentra excels at providing digital lending solutions and is known for enhancing efficiency in the loan process for financial institutions. However, as the fintech market is rapidly growing, users are eager to try new loan origination solutions that consist of the latest technologies and functionalities.

Here are the top reasons to consider Lentra alternatives:

| Cost efficiency: Alternatives offer a more cost-effective pricing structure to help you manage your budget without sacrificing advanced features and functionalities. Customization: Other platforms provide better flexibility and customization options that allow you to customize solutions as per your specific needs. User experience: Some alternatives have more intuitive user interfaces, which makes it easier for your team to adopt and use the platform appropriately. Specialized features: Different solutions deliver unique tools or functionalities that are suitable for specific types of lending or financial services. Integration capabilities: Alternatives offer better integration with your existing systems to improve overall workflow and efficiency. |

How we shortlisted the top alternatives to Lentra

We followed an in-depth process that included detailed market research and a thorough analysis of each alternative of Lentra. Here is the process we followed to list out the top Lentra competitors.

- We evaluated 20+ alternatives that specialize in delivering loan origination solutions.

- We assessed feedback and rankings of each alternative on websites like G2, Slashdot, SourceForge, and Capterra.

- We shortlisted the loan origination software based on several factors like features, pricing, integration capabilities, and customer support.

After this manual process, we came up with these Lentra competitors:

- HyperVerge – Best for streamlining the loan lifecycle

- Mortgage Automator – Best for automating document generation and management

- Floify – Best for accelerating loan processing

- Finflux – Best for unified loan application dashboard

- LendingPad – Best for enterprise API for synchronous data exchange

- CloudBankin – Best for seamless loan disbursement in minutes

- InteGREAT – Best for end-to-end digital loan origination management

- Jocata – Best for real-time data aggregation and processing

- FinBox – Best for reducing loan processing time with automation

- Vahana Hub – Best for integrated APIs for loan origination

The best options to consider as alternatives to Lentra

Here is the table with an overview of the 10 best loan origination systems.

| Top alternatives | Free trial availability | Best for | Targeted industries |

| A 30-day free trial is available with a sandbox environment | • Startups • Small-scale businesses • Mid-sized companies • Enterprises | • Financial services • Education • Gaming • Remittance • Crypto • Marketplaces • Logistics and eCommerce | |

| No free trial is available | • Small-scale businesses • Mid-sized companies | • Financial services • Real estate | |

| A free demo is available | • Small-scale businesses • Mid-sized companies | • Financial Services • Banking • Real estate | |

| A free proof of concept (POC) is available | • Mid-sized companies • Enterprises | • Banking • FinTech • Non-banking financial companies (NBFCs) | |

| A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | • FinTech • Banking • Financial services • Real estate • Construction | |

| A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | • Banking • NBFCs • FinTech | |

| A free trial is available | • Small-scale businesses • Mid-sized companies | • Financial services • Banking • Insurance | |

| A free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | • Banking • Financial services • Insurance • FinTech • Retail | |

| A 14-day free trial is available | • Small-scale businesses • Mid-sized companies • Enterprises | • Digital Lending • Finance • Banking • FinTech • SaaS | |

| No free trial is available | • Small-scale businesses • Mid-sized companies s• Enterprises | • Finance • Pharma • Food & groceries • eCommerce • Social media |

Top 10 Lentra competitors & alternatives to consider

1. HyperVerge

HyperVerge is a cloud-based identity verification platform that streamlines the loan origination process. The platform covers each phase of the loan lifecycle from initial application to final approval. The focus on automation and user-centric design ensures borrowers and lenders get an advantage from a streamlined and efficient process.

By using cloud technology, HyperVerge helps financial institutions manage loan origination anywhere anytime. The platform offers an intuitive interface and reduces technical complexities to help minimize the learning curve and operational hurdles. HyperVerge supports you in growing your business by providing exceptional scalability solutions.

The platform offers integration marketplaces with open APIs that allow businesses to integrate with existing systems to build efficient workflows. HyperVerge speeds up loan approvals and enhances security by providing automation and fraud detection solutions. This capability helps financial institutions save time and money while maintaining a high level of service quality.

Key features of HyperVerge

- Automated loan lifecycle management: Automates the entire loan lifecycle, from loan application intake to underwriting and closing. This not only reduces the manual work but accelerates the loan approvals.

- Fraud detection integration: Protects lenders and borrowers by identifying and mitigating potential fraudulent activities with its advanced fraud detection capabilities.

- Open API integration: Integrates easily with the existing systems using open API. This capability unifies and streamlines the loan origination process while reducing technical complications.

- Customizable no-code journey: Allows lenders to design and modify workflows without the requirement of coding expertise. Such flexibility helps tailor the loan origination process to meet specific lending requirements.

Client video testimonial

HyperVerge has a track record of serving 50+ clients in the lending sector, including L&T Finance, HomeCredit, ZestMoney, Avail Finance, and Slice. Here are the detailed testimonials of Avail Finance and HomeCredit.

1. Avail Finance

Recently, one of their clients, Avail Finance, integrated HyperVerge’s technology for remote onboarding. HyperVerge helped them reduce the onboarding time from 2-3 hours to under 1 second. This improvement also reduced customer drop-offs and lowered acquisition costs.

Check out what Deepak Malani, Head of Product at Avail Finance says about the impact of HyperVerge’s solutions.

2. HomeCredit

HomeCredit leveraged HyperVerge’s OCR technology to automate its finance processes, reducing error rates by 50% and cutting application processing time by a third. This streamlined their operations, ensuring faster, more accurate merchant onboarding, especially during peak business periods.

Here’s a video of how HomeCredit used HyperVerge and became a happy client.

2. Mortgage Automator

Mortgage Automator is an all-in-one loan origination and servicing software for private lenders. The software offers a suite of capabilities like borrower portals, automated doc generation, and communication tools that ensure streamlined lending operations.

Mortgage Automator offers an intuitive interface that ensures quick adoption along with powerful APIs to automate the lending processes. With Mortgage Automator, businesses get access to advanced functionalities that enable them to auto-generate custom documents, compliance reports, and payment processing.

By automating routine tasks, this platform assists you in building relationships, marketing, and finding new investors for your business growth.

Key features of Mortgage Automator

- Streamlined data import: Allows efficient data import using direct API integration, lead intake forms, bulk uploads, and manual data entry. This captures all the necessary borrower’s information with accuracy.

- Customizable workflows: Offers customizable options for workflows and communications. It helps create custom fields at the deal and contact level, set up automated communication triggers, and tailor workflows to suit your lending processes.

- Automated document generation: Simplifies documentation process by auto-generating docs and templates like pre-approvals, LOIs, term sheets, finding breakdowns, investor agreements, and payoff statements.

- Efficient communication: Ensures all the parties stay updated with automated SMS and email notifications. This keeps borrowers and lenders up-to-date on loan statuses and any required actions.

Mortgage Automator compared with Lentra

Mortgage Automator excels at providing advanced solutions like amortization schedules, audit trails, and closing documents, which Lentra lacks.

3. Floify

About Floify

Floify is one of the best loan origination software for lenders and brokers. By offering a streamlined approach, the software helps mortgage professionals provide a consistent and efficient homeownership journey.

The advanced functionalities of Floify attract top loan originators and provide tools to simplify compliance. This helps businesses in brand differentiation and optimizes operational workflows. With Floify’s borrower-centric approach, the software easily meets the diverse needs of mortgage brokers, credit unions, and regional banks.

The platforms ensure that every interaction is compliant and efficient with document management, automated disclosure workflows, and customizable solutions.

Key features of Floify

- Document management: Automates document collection and management to ensure the timely collection of the necessary documents. This reduces the administrative burden on loan officers and speeds up the loan approval process.

- Customizable workflows: Allows lenders and brokers to tailor the loan origination process to meet the unique requirements of diverse lending scenarios and improve operational efficiency.

- Easy integration: Facilitates smoother transitions and better data management to ensure that all loan origination tasks are managed within a unified platform.

- Automated disclosure workflows: Manages and distributes necessary disclosures throughout the entire loan process. This feature ensures compliance with regulatory requirements and accelerates the loan document preparation.

Floify compared with Lentra

Floify stands out from Lentra with its advanced pipeline management, comprehensive pre-qualification features, and focus on residential mortgages.

4. Finflux

About Finflux

Finflux is a loan origination system that is now a part of M2P Fintech. This system offers an integrated approach to loan origination that helps financial institutions onboard clients and manage the lending process. Also, Finflux excels at providing a unified dashboard to get a real-time overview of the lending value chain.

The software enables accurate credit scoring and streamlined decision-making by easily integrating with third-party credit risk vendors. Trusted by 60 leading global fintech organizations, Finflux ensures a smooth and transparent loan processing experience.

Finflux specializes in offering an advanced STP (Straight Through Processing) engine and one-click CART (Credit Application Review Tool) and CRAM (Credit Risk Assessment Module) analysis that optimizes the loan origination process.

Key features of Finflux

- Unified dashboard: Offers a 360-degree view of all the loan applications. This provides a complete perspective on the loan origination lifecycle.

- Credit scoring: Integrates automated credit scoring capabilities with a strong business rule engine to optimize borrower assessments and improve decision precision.

- Customizable workflows: Helps businesses to tailor workflows as per the specific requirements. This facilitates the introduction of new products and adapts to evolving business needs.

- STP process engine: Ensures efficient and automated processing of loan applications, minimizing manual intervention and boosting the loan process.

Finflux compared with Lentra

Finflux offers distinctive capabilities like CART & CRAM analysis and fee management, which is not available with Lentra.

5. LendingPad

About LendingPad

LendingPad is an end-to-end loan origination platform providing tools for banks, credit unions, and lenders. The system’s cloud-based architecture ensures accessibility from any location and its automation and real-time updates facilitate efficient operations and compliance.

With the Lender Edition of LendingPad, users benefit from easy integration with wholesale and correspondent channels and an enterprise API that supports complex data exchange. The platform allows users to adapt the system to their needs and scale operations.

LendingPad ensures an efficient and compliant lending experience from managing secondary market activities to performing post-closing tasks. Users can make informed decisions by including real-time pipeline monitoring, automated underwriting, and advanced data transfer capabilities.

Key features of LendingPad

- Automated underwriting: Automates the underwriting process to reduce manual intervention and accelerate decision-making. This feature ensures rapid loan approvals and maintains compliance with lending standards.

- Real-time pipeline monitoring: Offers real-time visibility into loan pipelines, allowing users to track each loan’s status. Such transparency helps in identifying bottlenecks and optimizing workflows.

- Integrated secondary market management: Supports users in managing the sale and servicing of loans. It includes automated pricing and eligibility adjustments based on market conditions.

- Customizable workflows: Provides customization options where lenders customize the platform to their specific operational needs, aligning the system with unique business processes and compliance requirements.

LendingPad compared with Lentra

LendingPad excels at integrating with DocMagic, FormFree, LenderHomePage, Pre-Approve Me, and QuickQual, whereas Lentra lacks these integration capabilities.

6. CloudBankin

CloudBankin is a user-friendly low-code platform known for its loan origination solutions. This cloud-based solution enables banks, NBFCs, and MFIs to process and disburse loans in minutes. The platform simplifies complex tasks like client onboarding and eKYC by delivering a fully digital experience.

By automated decision-making algorithms and third-party integrations, CloudBankin boosts operational efficiency and productivity. CloudBankin’s low code architecture allows financial institutions to tailor workflows and features as per the requirements. The software offers solutions that streamline loan products, facilitate swift onboarding, and support diverse clients.

With capabilities like mobile access, real-time analytics, and easy integration with existing systems, the software ensures reliable solutions that enhance customer experience and business growth.

Key features of CloudBankin

- Automated client onboarding: Simplifies the addition of new clients with an automated onboarding process that ensures a smooth and efficient experience.

- eKYC integration: Streamlines the collection and verification of the necessary documentation with a fully digital eKYC system.

- Quick decisioning engine: Uses an in-built credit rule engine that applies configurable parameters depending on the institution’s credit policies.

- Credit bureau integrations: Facilitates hassle-free assessment of customer credit scores by iterating with credit bureaus which allows for rapid and more informed lending decisions.

CloudBankin compared with Lentra

CloudBankin’s advanced capabilities like opening balances migration and financial activity mapping set it apart from Lentra.

7. InteGREAT

About InteGREAT

Developed by Perfios, the InteGREAT is a top-notch digital loan origination platform. This all-in-one solution facilitates smooth loan management from application to approval which enhances DSA’s efficiency.

The platform supports DSAs in various ways like managing loan applications, selecting the best loan options, and tracking application progress. InteGREAT allows institutions to customize and deploy loan solutions rapidly with its flexible workflows tailored to various loan products.

The software easily integrates with in-house Loan Management Systems (LMS) and Loan Origination Systems (LOS). InteGREAT stands apart with its focus on financial insights for underwriting, easy loan product creation, and secure identity & document verification.

Key features of InteGREAT

- Configurable workflows: Provides customizable workflows tailored to individual loan products, allowing institutions to adapt processes as per their specific requirements and optimize the application handling.

- Application tracking and monitoring: Offers tools that ensure both Direct Sales Agents (DSAs) and institutions have real-time visibility into application status and progress.

- Underwriting insights: Delivers in-depth financial insights to support underwriting and decision-making processes. This helps institutions assess loan applications with precision and make informed decisions.

- Easy loan product creation: Simplifies the creation and management of loan products and forms which enable businesses to deploy new loan offerings and adapt to changing market conditions.

InteGREAT compared with Lentra

InteGREAT provides customizable modular designs and repayment tracking, which Lentra does not offer.

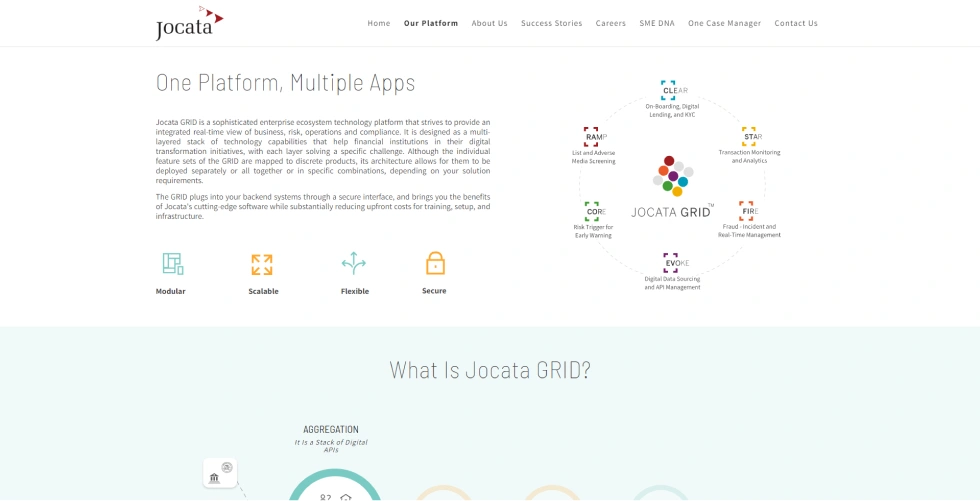

8. Jocata

Jocata is an end-to-end digital transformation platform that offers loan origination solutions. The platform excels in delivering accurate underwriting and risk assessment using advanced AI and machine learning technologies. This ecosystem handles millions of transactions daily and offers solutions that drive growth, streamline operations, and ensure regulatory compliance.

The platform’s ability to source and analyze information from several internal and external channels helps financial institutions with actionable insights. This enables businesses to make informed decisions and maintain compliance with evolving regulations.

Not just this, Jocata easily integrates across several business verticals to provide real-time data aggregation, processing, and insightful analytics.

Key features of Jocata

- Data aggregation: Consolidates and processes real-time data from financial institutions, credit bureaus, and social networks. This data collection supports accurate credit assessments and improves the precision of loan origination procedures.

- Smart underwriting: Uses advanced analytics and AI technology to conduct intelligent underwriting. The feature assists in evaluating application information in real-time to improve the speed and precision of loan approvals.

- Customizable workflow management: Enables financial institutions to create and adapt loan origination workflows that match their specific requirements.

- Risk assessment: Integrates tools that analyze applicant profiles and financial histories. This approach ensures effective identification and management of potential risks.

Jocata compared with Lentra

Jocata stands out from Lentra with its features, including behavioral analytics and compliance reporting.

9. FinBox

FinBox is a loan origination system that specializes in accelerating loan approvals with faster processing. The software enhances borrower acquisitions and conversion rates by allowing users to deploy a fully functional credit product within two weeks.

The system’s flexibility and automation capabilities support a diverse range of credit products and ensure compliance with necessary KYC requirements. FinBox solutions offer easy integration with 30 different platforms, simplifying account aggregation and repayment setup.

Not only this, the software helps manage loans from different sources like sales agents, branches, and online platforms. FinBox’s advanced analytics and tailored features help optimize loan funnels, reduce drop-offs, and accelerate customer journeys.

Key features of FinBox

- Automated decision making: Ensures quick approvals and reduces manual interventions which helps streamline the workflow and speeds up the loan processing times.

- Customizable UI/UX: Allows lenders to integrate credit processes easily into their existing applications. This ensures that the credit products appear native to the lender’s app to improve user engagement and be easy to use.

- Multi-channel integration: Support loan origination with various channels like direct sales agents, branches, and digital platforms. Such flexibility allows leaders to manage loan applications and approvals from different sources.

- KYC support: Enables lenders to integrate any form of KYC verification into the onboarding journey. Thai feature helps speed up compliance and reduce the time duration for loan approvals.

FinBox compared with Lentra

FinBox offers exceptional deployment capabilities that allow businesses to launch a credit product in two weeks, a speed unmatched by Lentra.

10. Vahana Hub

Vahana Hub is a loan origination platform that excels at streamlining and enhancing the fintech journey. The platform offers effortless integration with a huge number of APIs from diverse providers. This unified platform simplifies the entire procedure of discovering, testing, and using several APIs.

With its excellent infrastructure, Vahana Hub ensures that users access and manage APIs across diverse financial domains from banking to credit assessment. The platform supports digital KYC and fraud management using advanced AI and ML technologies.

This ensures reliable identity verification and document validation. Vahana Hub facilitates banking and financial analyses by allowing users to retrieve and analyze bank statements. With credit bureau integration and risk assessment tools, the software allows businesses to make informed lending decisions.

Key features of Vahana Hub

- Digital KYC: Allows thorough verification of individual and entity information using various databases and Aadhaar-based services.

- AI-enhanced OCR: Uses AI and ML technologies to enable accurate capture and verification of financial documents, enhancing the reliability of document processing.

- Bank statement analysis: Uses APIs to access and analyze bank statements. This feature provides valuable insights into financial behavior and assists in the loan assessment process.

- Credit bureau integration: Integrates major credit bureaus like TransUnion CIBIL and Equifax which allows users to retrieve credit scores and histories.

Vahana Hub compared with Lentra

Vahana Hub differentiates itself from Lentra by offering a unified platform that enables seamless integration with over 1,200 APIs.

Pick the right Lentra alternative for your business

Getting an efficient solution for loan origination impacts your business efficiency and customer satisfaction. BY considering leading alternatives to Lentra, you can find a reliable platform that offers enhanced functionality, error-free integration, and superior user experience.

Make an informed decision to elevate your loan origination process and drive better outcomes.

For those looking for a powerful and efficient loan processing platform, try HyperVerge ONE.

This advanced platform streamlines customer onboarding by allowing you to design and launch efficient financial acquisition journeys. HyperVerge ONE’s no-code workflow and intuitive UI builder enable you to create and optimize custom onboarding experiences. Schedule your free demo.

Frequently asked questions about Lentra alternatives

1. What kind of company is Lentra?

Lentra is a digital lending software company specializing in providing lending solutions. The platform streamlines the lending process from loan origination to disbursement. Lentra uses advanced technologies like AI and machine learning to improve efficiency, reduce processing times, and improve the entire customer experience in the lending sector.

2. Are there any free alternatives to Lentra available?

Here are some of the free alternatives to Lentra available in the market.

- HyperVerge

- LendingPad

- CloudBankin

- Floify

- Finflux

3. What factors should I consider when choosing an alternative to Lentra?

Here are the factors to consider when choosing an alternative to Lentra.

- Ensure the features align with business needs like loan origination, credit scoring, and compliance management.

- Check if the platform can accommodate an increasing volume of loans and expanding operations.

- Confirm that it integrates easily with existing systems like CRM and accounting software.

- Compare pricing plans and check if they fall within your budget, noting any hidden fees or charges for premium features.

- Ensure the provider offers strong customer support and training resources for optimal use.