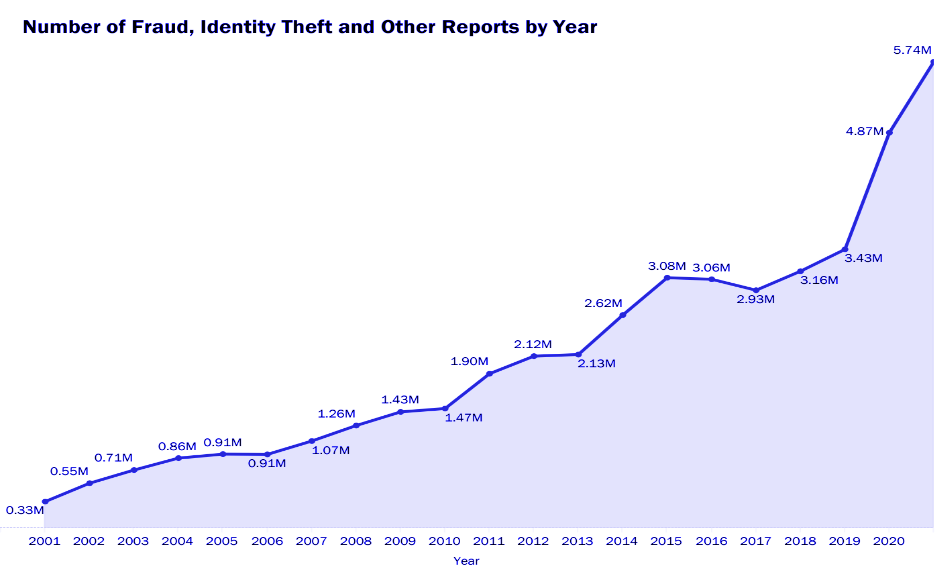

Frauds have been increasing every year in the US. According to the FTC’s Consumer Sentinel Network data book, they received 5.74 million reports in 2021, up from 4.87 million in 2020, representing an 18% increase. This represents a significant increase from previous years and suggests that fraud in financial institutions is indeed on the rise.

Additionally, the Association of Certified Fraud Examiners (ACFE) estimates that organizations lose an average of 5% of their revenue to fraud each year, with a median loss of $125,000 per fraud case. These losses can be even higher in financial institutions, where the potential for large-scale fraud is greater.

Moreover, in a survey conducted for the 2022 State of Fraud Report by Alloy, 91% of respondents said fraud increased year-over-year since 2021.

Overall, the increasing prevalence of financial fraud in the United States is a significant concern for both individuals and institutions and highlights the need for improved prevention and detection measures.

Types of frauds

The Federal Trade Commission’s Consumer Sentinel Network data book also identifies 28 categories of fraud reported by consumers. The most common types of frauds which contributed to 60% of the 5,737,265 frauds reported in the US in 2021 were identity theft(25.01%), imposter scams(17.16%), Credit Bureaus, Information Furnishers and Report Users(10.33%), and online shopping scams(6.94%). Below are some of the frauds mentioned in the report.

- Imposter Scams: Scammers pose as someone else to trick victims into giving them money or personal information.

- Identity Theft where the fraudster steals someone’s personal information to commit fraud.

- Online Shopping Fraud: Scammers use online marketplaces or fake websites to take payments for goods that are never delivered.

- Credit Bureaus, Information Furnishers, and Report Users: Issues with credit reports or credit monitoring services.

- Banks and Lenders Fraud such as fake loan offers or unauthorized account access.

- Phone and Mobile Scams such as fake tech support or unauthorized charges.

- Health Care fraud such as fake medical billing or insurance scams.

- Prizes, Sweepstakes, and Lotteries Sams

- Debt Collection scams where debt collectors threaten victims to pay fake debts.

- Shop-at-Home and Catalog Sales Scams where scammers take payments for goods that are never delivered in shop-at-home or catalogue sales.

- Internet Services Scams such as fake antivirus software or tech support scams.

- Foreign Money Offers and Counterfeit Check Scams where scammers offer to transfer foreign money in exchange for fees or deposit fake checks and request a portion of the funds.

- Business and Job Opportunities Scams such as pyramid schemes or fake job offers.

- Credit Cards Frauds such as unauthorized charges or fake offers for new credit cards.

- Internet Auctions Scams such as fake auction sites or fraudulent bids..

- Education Scams such as fake education/student loan consolidation services.

- Investment-Related Scams such as Ponzi schemes or fake stock offers.

- Buying and Selling Scams such as fake classified ads or fake escrow services.

- Advance Payment for Credit Scams offering fraudulent credit repair or debt consolidation services for upfront fees.

Cost of these frauds

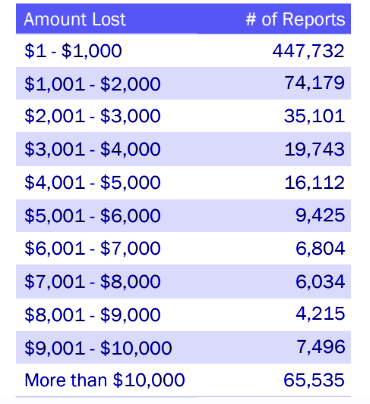

According to the Federal Trade Commission’s Consumer Sentinel Network data book, out of 5.74 million reports they received, 25% of reports were with $ loss. Moreover, according to the US Federal Trade Commission (FTC), fraud-related losses reported by Americans surged by over 70%, amounting to a staggering total of more than $5.8 billion in 2021.

The estimated cost of fraud for U.S. financial institutions in 2021 was $4.2 billion, which represents a 28.7% increase compared to the previous year. The report also highlights that synthetic identity fraud continues to be a significant challenge for financial institutions, accounting for 37% of all fraud losses in 2021.

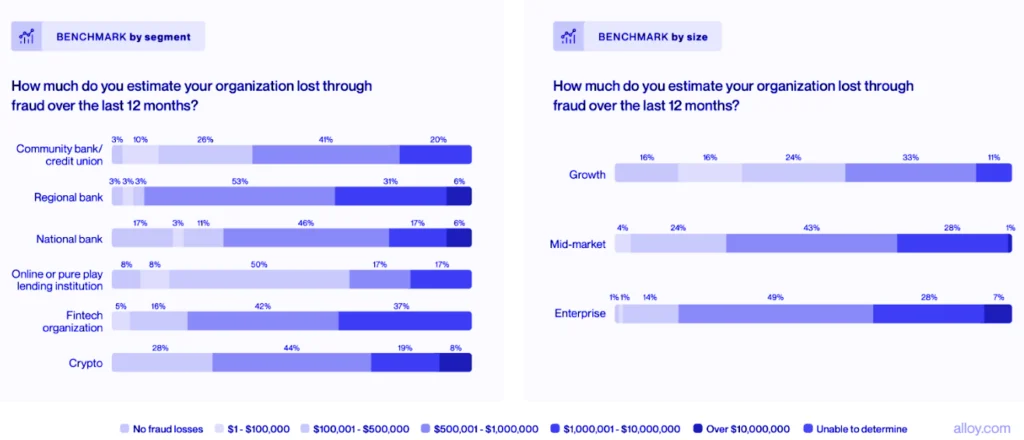

According to the Alloy State of Fraud report for the year 2022, a significant number of respondents reported substantial financial losses due to fraud. In the past twelve months, 70% of respondents stated that they had lost more than $500,000. Additionally, 27% of respondents reported losses exceeding $1 million due to fraudulent activities during the same period. These figures highlight the staggering impact of fraud on businesses and individuals in the US.

Case studies of recent frauds which could’ve been controlled by a robust KYC system

Case Study 1: Woman Used Identities of Dead People to Defraud in US

Katrina Pierce, a Chicago woman, was sentenced to just over five years in prison after fraudulently obtaining the identities of dozens of dead people, from infants to adults, and using the information to steal more than $45,000 of government funds. Pierce acquired more than 36 death certificates for murder victims in Illinois from 2019 to 2021 by pretending to be related to them. She then used personal details, such as dates of birth and Social Security numbers, gleaned from the documents to file for tax refunds and pandemic stimulus payments. She was charged with multiple counts of wire fraud and aggravated identity theft and pleaded guilty to one count of wire fraud and one count of aggravated identity theft. Pierce has a history of committing fraud and was under supervised release from her last conviction when she committed this latest crime, which was her fourth federal fraud conviction.

Case study 2: Fraud, Identity Theft Scam at BetMGM

In this case, a scammer created an account on BetMGM West Virginia using the name of the victim, Witteles, without his knowledge. They were able to make a deposit of $10,000 from Witteles’ bank account onto the BetMGM platform and immediately withdraw it to a Venmo Demit Mastercard linked to a phony Venmo account also created in Witteles’ name.

Witteles claims that the scammer was able to exploit a service offered by Global Payments Gaming (GPG) called “VIP Preferred.” This service allows users to deposit funds to their online gaming accounts directly from their bank accounts without needing to enter their account information each time.

Case study 3: Man Convicted to Obtain over $3 Million in Loans, Cars and Cash

Turhan Lemont Armstrong, a man from Los Angeles, was sentenced to over 21 years in federal prison for running a $3.3 million fraud scheme. Armstrong used stolen identities and Social Security numbers, primarily those of children, to obtain credit cards, open bank accounts, set up shell companies, apply for loans, and purchase assets. The scheme went on for nearly a decade before he was caught, and he failed to report any income to the IRS between 2009 and 2017. Armstrong was found guilty of all 51 counts in his 2019 federal grand jury indictment, which included financial institution fraud, money laundering, and aggravated identity theft. It is important to protect your personal information and avoid sharing your child’s Social Security number whenever possible, and take immediate action if a data breach occurs.

Industry segments and the US states prone to fraud

According to the FTC report, out of 5.7M reports they received,

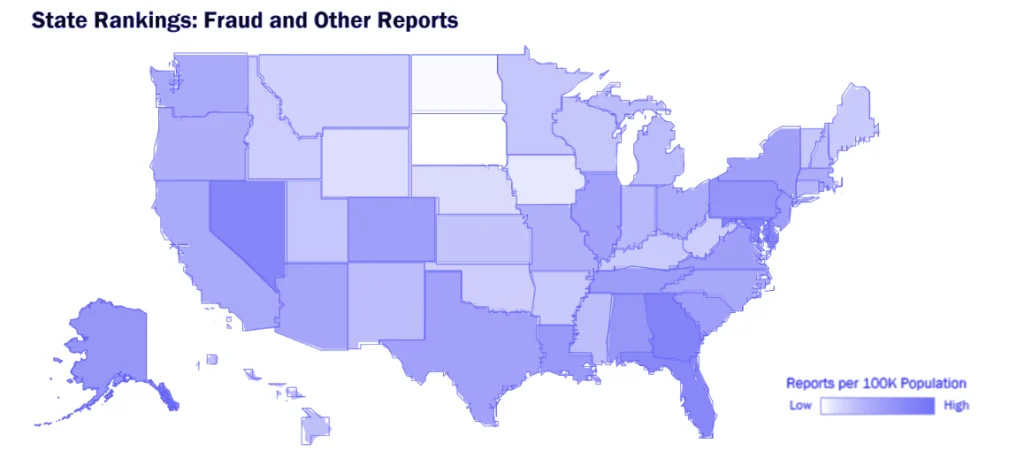

- The top 5 states with the highest number of frauds per 100K Population were Georgia, Maryland, Delaware, Nevada and Florida.

- The top 8 states with the maximum number of fraud reports were California(391,517), Texas(313,044), Florida(294,328), New York(210,749), Pennsylvania(154,313), Illinois(136,640), Ohio(114,140) and North Carolina(108,698).

- The top 5 states with the most Identity thefts were Rhode Island, Kansas, Illinois, Georgia and Louisiana.

For finding fraud in each state, you can visit the link here.

Some of the few industry segments that are more prone to fraud in the US are:

- Financial institutions: Banks, credit unions, and other financial institutions are prime targets for fraudsters looking to steal money from accounts or obtain personal information about customers. Some common types of fraud in this industry include account takeover, check fraud, wire fraud, and insider fraud.

- Online marketplaces: E-commerce platforms like Amazon and eBay are popular targets for fraudsters because they offer a large customer base and easy access to personal information. Some common types of fraud in this industry include phishing scams, account takeovers, and fake sellers.

- Gaming platforms: Online gaming platforms, such as mobile games and virtual reality games, have become popular targets for fraudsters looking to steal in-game currency or personal information. Some common types of fraud in this industry include account takeover, phishing scams, and fake games or apps.

- Insurance companies: Insurance companies are vulnerable to fraud from customers and employees. Some common types of fraud in this industry include false insurance claims, identity theft, and insider fraud.

- Cryptocurrency exchanges: Cryptocurrency exchanges are a relatively new industry, but they have already become a popular target for fraudsters. Some common types of fraud in this industry include exchange scams, phishing scams, and Ponzi schemes.

Predictions for 2023

As per industry reports, as digital payments continue to increase, synthetic fraud is expected to rise, where fraudsters build fake identities with credit histories over multiple years before using them to apply for accounts. A lot of the personally identifiable information (PII) stolen in early 2020 is expected to surface in 2023-24, leading to a rise in frauds like employment-based fraud and other scams. Scammers take advantage of people’s uncertainty and offer fake assistance in exchange for social security numbers, bank account information, and other PII data. The fraudsters then use this information to apply for new credit cards or open bank accounts without the actual person’s knowledge.

Fraudsters are always on the lookout for new ways to exploit vulnerabilities in the system, and 2023 is expected to be no different. According to the latest industry reports, the trend of fraud is expected to continue rising. Below are a few trend predictions for the coming years –

- Synthetic identity fraud will continue to rise due to the continued digitization of payments.

- Account takeover fraud will remain a significant threat, particularly for businesses that rely on usernames and passwords.

- Impostor scams will become increasingly sophisticated and prevalent, particularly those involving deep fake technology.

- The use of machine learning and artificial intelligence will become more widespread in the fight against fraud, helping to identify patterns and anomalies in data.

- The adoption of Identity verification methods will increase, reducing the likelihood of identity theft and account takeover fraud.

- Small and medium-sized businesses will remain vulnerable to fraud due to limited resources and a lack of cybersecurity expertise.

How can IDV and database checks help fight fraud?

Identity verification (IDV) and database checks are important tools in the fight against fraud. These techniques are used to confirm the identity of individuals and to detect fraudulent activities. These checks are typically used by businesses and organizations that need to verify the identity of their customers, clients, or employees.

Here are some ways that help fight fraud:

- Confirming identity: IDV and database checks can help businesses and organizations confirm the identity of their customers or clients. This can be done through a variety of methods, such as matching personal information against government databases or biometric authentication. By confirming the identity of individuals, businesses, and organizations can reduce the risk of fraudulent activities.

- Reducing impersonation fraud: Impersonation fraud occurs when someone pretends to be someone else in order to gain access to personal or financial information. IDV and database checks can help prevent impersonation fraud by verifying the identity of individuals before granting access to sensitive information or services.

- Preventing account takeover: Account takeover occurs when someone gains access to another person’s account without their permission. IDV and database checks can help prevent account takeover by verifying the identity of individuals before granting access to their accounts.

- Detecting fraudulent activities: IDV and database checks can help detect fraudulent activities by comparing personal information against known fraud databases or by using machine learning algorithms to detect patterns of suspicious behavior. By detecting fraudulent activities early on, businesses and organizations can prevent financial losses and minimize the impact on their customers.

How does HyperVerge help?

By leveraging Hyperverge’s powerful database and identity verification software solution, institutions can quickly and accurately authenticate customers and detect potentially fraudulent activity. Below are some HyperVerge solutions that can help alleviate some of the burdens.

- Cross-verifying user information against a wide variety of databases – central and proprietary

- Detecting potentially fraudulent activity by monitoring signals from the phone, e-mail, and IP address.

- Multi-modal data validation by matching ID card information with the information present in available formats like barcode (present in US DL cards), MRZ (present in all passports), and NFC chip (mDL)

- Helps combat identity fraud and money laundering which includes a face deduplication search

- Improves the customer onboarding experience

- Reduces manual time and effort required to verify identities

- Maintains the highest level of security

- Helps reduce cost, ease out integration, and customization using in-house technology

- Quickly and accurately authenticates customers

- Mitigates fraud risk and improves the bottom line

For more information, contact us.

FAQs

How can Know Your Customer (KYC) processes help businesses prevent fraud?

KYC processes can help businesses verify the identity of their customers and ensure that they are who they say they are. This can help prevent fraudulent account openings and reduce the risk of frauds like account takeover, identity theft, imposter scams etc.

What are the most common types of fraud happening in the US?

The most common types of frauds which contributed to roughly 42% of the total frauds reported in the US in 2021 were identity theft & imposter scams.

Which US states have the highest frauds?

The top 5 states with the maximum number of fraud reports in 2021 were California, Texas, Florida, New York & Pennsylvania.

US

US

IN

IN