Why do some investment platforms convert over 60% of leads while others lose half their prospects before onboarding even begins?

Our Annual WealthTech Onboarding Report uncovers the reasons. Based on real platform performance data, the report pinpoints where investors drop off, how top firms like Groww sustain 60–65% conversion, and which strategies separate leaders from laggards.

We have identified the top five insights from the report that everyone in WealthTech should note.

1. India’s $95B WealthTech Market: Growth Beyond Urban Hubs

India’s WealthTech market is on track to hit $95 billion by FY30, representing a nearly 5x expansion from approximately $20 billion in FY20. But here’s what makes this growth different: it’s not just about scale, it’s about reach.

Nearly half of new investors are coming from younger demographics, and crucially, they’re not concentrated in traditional financial hubs. Smaller cities are driving this expansion, with the total investor base expected to more than double in numbers.

This geographical shift creates both opportunity and complexity. The winners will be platforms that work well for everyone – whether someone has slow internet, an older phone, or limited experience with digital payments. These adaptable platforms will gain a huge advantage. Meanwhile, platforms that only work well in ideal conditions will be stuck fighting over the same crowded urban markets where growth has already slowed.

You can learn more about the exact demographic changes in the industry and their implications in the annual WealthTech Onboarding Report.

2. Why 10-Minute Onboarding Decides Winners

Getting new users signed up online used to be a bonus feature. Now it determines whether companies succeed or fail. The best platforms can get someone fully registered in just 10 minutes, but if you’re slower, you’re losing 1 in 4 customers.

Automated identity checks, instant verification, and smart systems that adjust based on how users respond are driving this transformation. The performance gap is stark. Platforms with optimized digital onboarding achieve conversion rates over 60%, while traditional methods typically hover around 20-30%.

However, speed without substance creates its own problems. The most successful implementations balance velocity with verification, ensuring compliance requirements do not become conversion killers.

3. Selfie & PAN Checks: Hidden Conversion Killers

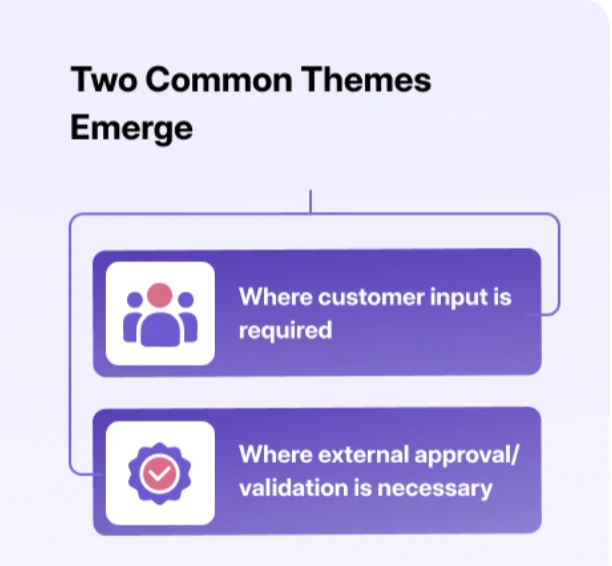

The report’s analysis reveals that selfie validation and PAN verification account for nearly half of the total drop-offs. It quantifies exactly how much attrition happens at selfie and PAN steps, exposing the biggest hidden drain on your funnel.

The real breakthrough isn’t just knowing where people give up, it’s figuring out why. Blurry cameras, server downtimes, unclear steps, and glitches pile up into friction that feels impossible to overcome, even when fixes exist. Platforms that tackle these issues head-on see conversions jump immediately.

Leading players are using fallback orchestrators, which are automated systems that reroute users through alternative verification paths when the primary one fails. Paired with smarter error handling, these solutions lift conversion rates from 25% to over 60%.

4. Superior CX = 5.7x More Revenue

The data is unambiguous: platforms with stronger CX deliver 5.7x more revenue. With 71% of consumers expecting personalized, frictionless engagement, customer experience has become the primary revenue driver.

Top-performing platforms share common characteristics. They use analytics to spot problems before users hit them, personalize the sign-up process for different user segments, design simple and clear interfaces, and fix issues in real-time.

This creates a snowball effect for revenue. When sign-up works smoothly, three outcomes occur at once: higher conversion rates, increased user engagement, and better customer retention. Each outcome reinforces the others, creating a compounding advantage that becomes harder for competitors to match over time.

5. RegTech & SEBI eKYC: Scaling Faster Through Compliance

SEBI’s introduction of eKYC, vKYC, and regulatory sandbox frameworks is not just to check compliance boxes, but to help financial platforms sign up customers instantly and grow faster. Companies that can quickly adopt these new systems get a big head start.

The regulatory environment is creating a two-tier market. Platforms that can rapidly integrate new compliance requirements gain first-mover advantages, while companies stuck with legacy systems find it harder and more expensive to keep up with changing rules.

No-code onboarding platforms and RegTech solutions are emerging as critical infrastructure. They help launch products faster, customize experiences for different users, and instantly adapt when regulations change. This technological foundation is becoming as important as the financial products themselves.

The Bottom Line

The message is clear: Winners deliver rapid onboarding without sacrificing compliance, provide personalized experiences at scale, and adapt quickly to regulatory shifts.

The $95 billion market opportunity belongs to companies that solve the tough, unglamorous problems of digital financial services. The next wave of success will come from infrastructure rather than innovation theater.

For WealthTech players, the focus should be on conversion rates, time-to-onboard, regulatory adaptability, and customer experience scores. These operational metrics predict revenue better than feature lists or funding rounds.

The full report contains implementation frameworks, platform benchmarks, along with detailed data points and strategic recommendations for each insight. The data shows not just what works, but why, and how to make it work for your business.

Download your copy now to get the complete analysis and actionable strategies.