Build end-to-end financial product onboarding journeys with ease

Configure user onboarding workflows and UI/UX without code.

Set automated fallback options to prevent user drop-offs during downtimes

Get analytics on conversion rates and optimize the friction points

Explore our Integrations Marketplace

Visit Page >What are the challenges with bank account verification?

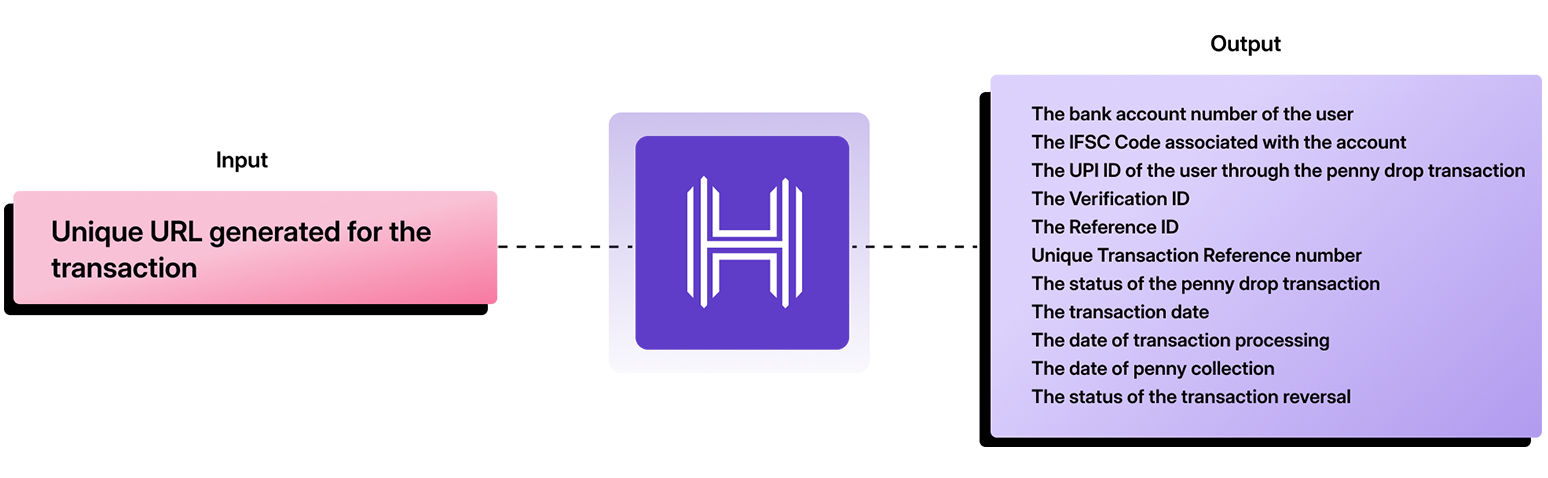

What is reverse penny drop verification?

Why is bank account verification important?