Permanent Account Number (PAN) card is an essential document issued by the Indian government. This card acts as proof of identity for Indian citizens. It is essential for crucial tasks like financial transactions, tax filings, and staying compliant with regulations.

PAN card verification is an important process aimed at confirming the authenticity of details extracted from the PAN card. It involves cross-referencing the details provided on the PAN card with centralized government databases.

he Income Tax Department recommends institutions and entities set up an online PAN verification facility to ensure successful validation of customers’ credibility. This ensures accuracy and reliability in confirming crucial information such as the name, address, and other essential data of the PAN holder.

PAN Card Verification API consists of two main components: PAN Card OCR and PAN Verification.

The PAN Card OCR API is designed to extract text information from images or scans of PAN cards. This is achieved through advanced Optical Character Recognition (OCR) algorithms. Here’s a breakdown of how it operates:

1. Image Capture: Capture an image of the PAN card.

2. Pre-processing: The clarity of the image is enhanced to improve OCR accuracy.

3. Text Recognition: Identify text regions and segment characters using OCR technology.

4. Character Recognition: Utilize visual features or machine learning to recognize characters accurately.

5. Text Extraction: Extract the recognized text into a digital format, typically including the PAN holder’s name, date of birth, and other relevant details. The confidence score for the extracted fields is also given as an output.

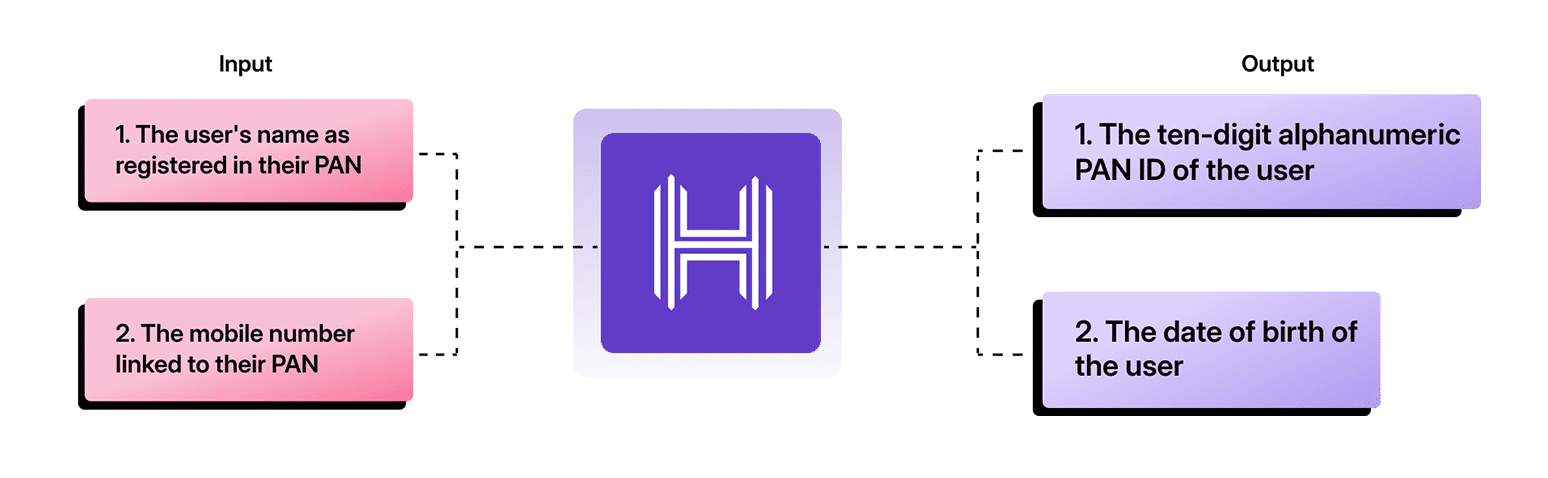

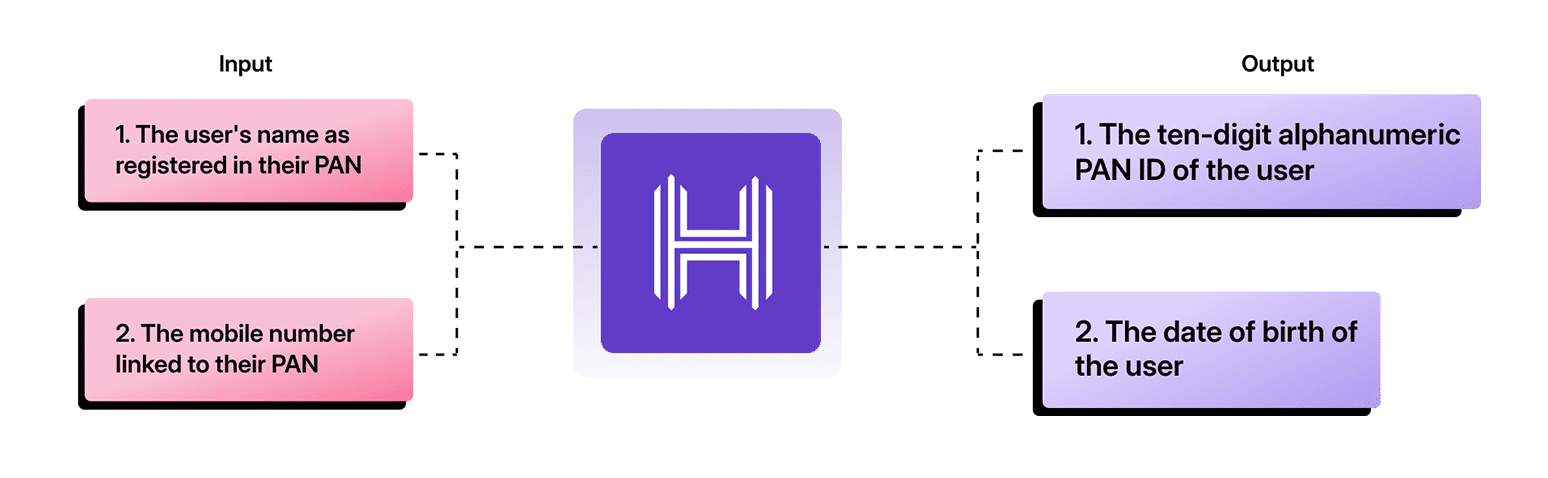

The PAN Card Verification API verifies the authenticity of the PAN card using the extracted information. Here’s how it functions:

1. Input: Provide the extracted user name and registered mobile number as input to the PAN Verification API.

2. Query: The API queries authorized databases to validate the information against official records maintained by tax authorities.

3. Validation: Based on the query results, the API generates the date of birth and PAN number as a validation result indicating the authenticity and validity of the PAN card details.

Thus the overall process of the PAN verification API is:

1. Integration: Integrate the PAN Card OCR and PAN Card Verification APIs into your system using unique API keys provided by the service provider.

2. Data Input: The scanned image of the PAN card is given as input to the PAN Card OCR API.

3. OCR Processing: OCR technology extracts the text from the scanned image.

4. Verification Query: Query authorized databases to validate the extracted PAN number against official records.

5. Validation Result: Receive a validation result indicating the authenticity of the PAN card details.

6. Response: The API sends back the validation result to the requesting system or application in JSON, XML, or plain text format.

This process ensures that PAN card details are verified accurately and reliably. Thus, ensuring that identity verification in financial transactions is trustworthy.

Are you currently using multiple disjointed solutions for your financial product onboarding process? With HyperVerge ONE, you can create smooth end-to-end journeys easily. Our integration features allow you to set up user onboarding and design user-friendly experiences without coding.

Concerned about user drop-offs during system downtimes? HyperVerge helps you set up automated backup options for a seamless experience. Moreover, you can delve into detailed analytics on conversion rates, pinpointing and refining friction points to elevate user experience and success rates.

Explore HyperVerge ONE here. Want to see how it works? Request a customized demo here.

What is PAN Verification?

PAN Card Verification is the process of confirming the authenticity of PAN card details, such as name, date of birth, and PAN number, through official channels.

What is screen-based verification for PAN cards?

Screen-based verification involves verifying PAN card details by displaying them on a computer or device screen and cross-referencing them with official records.

What is a digital signature certificate, and why is it needed for PAN verification?

A digital signature certificate is a secure electronic signature used to sign documents online. It may be required for PAN verification to ensure the security and authenticity of online transactions.

How long does it take for PAN verification to be completed?

The time taken for PAN verification may vary depending on the method used and the workload of the verifying authority. However, online verification processes are usually completed quickly.